Sanctions, PEPs and adverse media: Screening out risks to your business

Global fines for failing to prevent money laundering increased by more than 50% in 2022, according to a recent report in The Financial Times. The cost in fines for failing to observe adequate customer due diligence and breaching sanctions reached almost $5bn in the last year.

Calculating the reputational cost to those banks and other businesses is less easy. As contemporary international conflicts and political corruption have increased, attitudes among investors and legitimate customers to poor know your customer (KYC) compliance appear to be hardening.

To avoid inadvertently abetting crime and reduce the risk of penalties and reputational damage, businesses must screen customers and continue to monitor for PEPs, sanctions and adverse media as part of a risk-based approach to anti-money laundering (AML) and the customer due diligence activities that support it.

Screen out exposure to high-risk individuals and businesses

Who or what is a politically exposed person?

The Financial Action Task Force (FATF) describes a ‘politically exposed person’ (PEP) as someone who “has been entrusted with a prominent function” and “holds positions that can be abused for the purpose of laundering illicit funds or other predicate offences such as corruption or bribery.”

Individuals falling into this potentially high-risk category include heads of state, government ministers or senior government executives, high-ranking judges and military officers, central bank governors and board members, among others.

As access and influence are central to the risk represented by PEPs, it’s not only the individual holders of high office that are seen to be politically exposed, but anyone close enough to that person to potentially influence her or him to act corruptly, accept bribery or exploit a trusted public position.

What is adverse media?

Adverse media refers to negative or damaging information in the public realm that is a red flag for potentially high-risk individuals, organizations, or entities.

This negative news or reporting may relate to known instances of corruption, fraud, money laundering and financial crimes or may also include the financing of terrorism and other illegal activities. Such evidence of potential risk might appear on social media, news media or articles as well as in court records, regulatory filings and other open sources of information.

“A politically exposed person is someone who has been entrusted with a prominent function and holds positions that can be abused for the purpose of laundering illicit funds or other predicate offences such as corruption or bribery.”

What are sanctions and sanctions lists?

Sanctions can be applied to individuals, countries, groups or companies. They usually take the form of economic restrictions on trade and financial transactions and are designed to punish, restrict or prevent certain activities.

The most frequently applied sanctions are:

- Financial sanctions on individuals, governments and associated companies

- Bans on the import of raw materials or goods from the sanctions target

- Travel bans on named individuals

- Financial sanctions on proscribed groups, such as terrorist groups, and the individuals associated with them

- Embargoes on exporting or supplying arms and associated technical assistance, training and financing

- Bans on the export of equipment that might be used for internal repression

Sanctions watchlists

Major regulatory bodies producing consolidated watchlists of financial sanctions include:

Australia

The Department of Foreign Affairs and Trade (DFAT) lists persons and entities sanctions under Australian law.

European Union

Directorate-General for Financial Stability, Financial Services and Capital Markets Union produces a consolidated list.

United Kingdom

The Office for Financial Sanctions Implementation (OFSI) maintains a list of targeted individuals and entities.

United Nations

The UN Security Council applies comprehensive economic and trade sanctions as well as financial or commodity restrictions.

United States

The Office of Foreign Assets Control (OFAC) is the implementing authority for financial sanctions in the USA.

Up-to-date sanctions monitoring and screening protection

Why screen for PEPs, sanctions and adverse media?

Regulated businesses are required to take a risk-based approach to anti-money laundering and the prevention of fraud and other criminal activities. For these businesses, compliance with KYC/AML regulatory requirements requires screening.

Screening for ‘high-risk’ individuals, such as PEPs; adverse media references to known money launderers, fraudsters and terrorists; as well as sanctioned individuals, entities or countries, is part of a risk-based approach to customer due diligence and good practice for any business.

There are a number of reasons why screening is important:

- To comply with regulatory requirements

- To comply with local and international laws

- To avoid inadvertently abetting crime

- To avoid reputational damage

- To reduce the risk of regulatory fines, penalties or prosecution

Not all PEPs are up to no good

If a prospect or customer appears on a PEP watchlist it doesn’t mean that they are definitely corrupt or that you shouldn’t be in business with them. It does mean that you will have to exercise more vigilance in your business dealings with that customer.

For regulated businesses, that means you must perform enhanced due diligence (EDD) checks and demonstrate that you have conducted PEP screening.

Adverse media, compliance and controversy

Similarly, customer due diligence for regulated businesses requires that media screening takes place, looking for negative news of corruption, fraud, money laundering and financial crimes. Like PEP status, the presence of adverse media is not an automatic bar to onboarding or continuing to do business, however it can elevate the relationship to high risk, requiring EDD checks.

Regulated or not, doing business with individuals or companies courting controversy in the press is not the best look for a brand keen to protect its public perception.

Just say ‘no’ to sanctioned individuals and businesses

Businesses should not accept as customers, individuals or entities who are subject to financial sanctions. The US, UK, EU and other countries and international bodies apply sanctions on countries, businesses and individuals to prohibit doing business with them; these sanctions lists flag proscribed people, businesses and countries.

The Global State of Digital Identity Report 2023

For this report, we spoke to business leaders around the world in Australia, France, Germany, Spain, the UK and USA; decision-makers working in financial services, fintech, gaming, retail, insurance and the public sector.

Get insights from more than 300 business leaders around the world

Best practice for PEPs, sanctions & adverse media

Streamline and automate screening

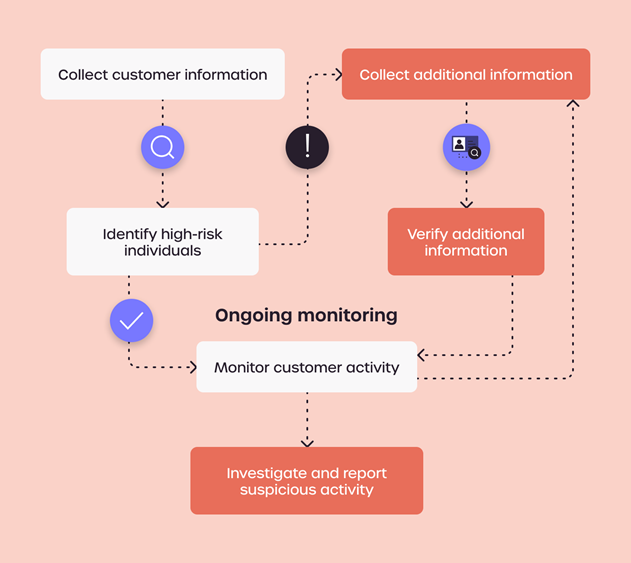

Most businesses run identity data verification checks at onboarding and during in-life transaction monitoring. Streamlining and automating your checks into a multi-layered risk assessment that covers customer due diligence and screening for PEPs, sanctions and adverse media is the most efficient and cost-effective approach.

Solutions that can perform comprehensive KYC checks and screening, leveraging data into a single view of a customer’s overall risk level is optimal. This ensures that your business doesn’t miss any red flags that show up and allows for more effective compliance reporting.

Getting the source data right

When it comes to PEPs and sanctions screening, many businesses choose to use multiple watchlists rather than rely on just one source. This approach helps to mitigate some of the data challenges presented by screening:

- Global inconsistencies in watchlists

- Country-specific watchlists

- Partial or incomplete watchlist data

- Volume of changing data (PEPs are constantly changing)

- Irregular updates to some watchlists

Screening solution providers can also unconsciously present regional bias in the different levels of data coverage they provide, so you need to make sure your business is covered to match your market presence and compliance needs.

Increasing your access to data sources helps to ensure your business is screening against up-to-date, market-specific information and managing customer relationships based on real-time assessments of the level of risk, reducing your exposure to sanctions violations, fines or reputational damage.

Managing false positives effectively

When screening for PEPs, sanctions and adverse media, a data match that incorrectly flags an individual as high risk is referred to as a ‘false positive’. Common names are a common cause. If a ‘John Smith’ is returned to high political office somewhere in the world, there are suddenly a lot of false positive results.

Managing these occurrences effectively is important if your business is to avoid unnecessary enhanced due diligence or copious, expensive manual intervention. Digital identity data matching against several data points, multiple credit bureaus or mobile network operators are common methods of excluding a false positive. Identity document proofing is another. However, reducing the overall number of false flags returned by the screening process is the first and best way to manage the problem, so your screening solution should be able to manage this effectively.

Customer relationships flagged to be of higher risk require enhanced due diligence.

PEPs and enhanced due diligence

Enhanced due diligence (EDD) for high-risk customers is required in regulated industries and a recommended best practice for all businesses. Customer relationships flagged to be of higher risk after screening for PEPs or the presence of adverse media, will need extra scrutiny to stay on the right side of compliance and on top of those concerns. Enhanced due diligence can include:

- Additional proof of identification

- Evidence of the source of wealth or funds

- Closer scrutiny of the nature of the business relationship

- Sign-off by a director and money laundering reporting officer (MLRO)

- Ongoing customer monitoring

“Enhanced due diligence for high-risk customers is required in regulated industries and a recommended best practice for all businesses.”

Ongoing customer monitoring

The world doesn't stand still; positions of power and influence come and go, conflicts and controversies arise and the trade risks associated with people, places and businesses go up and down.

Screening for PEPs, sanctions and adverse media is not a one-and-done process at customer onboarding. Watchlists for PEPs and sanctions are routinely updated, so staying on top of your in-life customer relationships for changes in status is advisable. Screening solutions that offer ongoing monitoring of your customers’ status and alert you to changes in their risk profile are a useful addition to customer due diligence at onboarding.

Compliance training for PEPs and sanctions

If your business has customer relationships with politically exposed persons, compliance training for your team is important to manage that relationship. This will include establishing internal policies and documentation procedures for dealing with these high-risk customers and ensuring that governance and management structures are in place to monitor your relationships over time.

Screening essentials for PEPs, sanctions and adverse media

Our trust-building solutions are designed to ensure your business knows exactly who you are permitted to transact with, screening for PEPs, sanctions and adverse media, and helping your business to monitor and manage high-risk customer relationships.

GBG screening runs essential screening checks at customer onboarding and, or at the time of transaction.

Global and local PEPs and sanctions screening

Our screening solutions . We continuously check against the big global sanctions watchlists (UN, EU, OFAC and OFSI) for new releases, as well as monitoring locally-enforced national sanctions watchlists to match your market presence and compliance needs.

Results with false positives eliminated

Letting a sanctioned individual or business entity slip through the net can result in hefty fines, so our screening solutions sift with a fine mesh. Our proprietary fuzzy search algorithms run multiple simultaneous searches crosschecking name variations and sequences. The result ensures false positives are quickly eliminated without the need for extensive manual intervention from your team.

Adverse media monitoring and audit trail

Our enhanced screening adds adverse media searches to your screening checks. We scan millions of current and relevant media articles and records for signs of involvement or alleged involvement in criminal activities, listing the sources where they appear.

As we seek out customers who could be liabilities to your business, we create a permanent audit trail of referenced sources and supporting evidence, categorised for your quick reference and available to download.

Ongoing monitoring and protection

Screening for PEPs, sanctions and adverse media is an ongoing challenge for risk management and compliance . Our screening solutions offer ongoing monitoring of individuals and entities beyond onboarding, so your business stays up to date with in-life status changes and is better protected from high-risk customers and the fines working with them can incur.

Ongoing monitoring for PEPs and sanctions after onboarding

Frequently Asked Questions

Who is a politically exposed person?

The Financial Action Task Force (FATF) describes a ‘politically exposed person’ (PEP) as someone who “has been entrusted with a prominent function” and “holds positions that can be abused for the purpose of laundering illicit funds or other predicate offences such as corruption or bribery.”

Anyone close enough to that individual to potentially influence her or him to act corruptly, accept bribery or exploit a trusted public position, is also regarded as ‘politically exposed’.

Who compiles sanctions lists?

There are several international and national regulatory bodies producing watchlists of financial sanctions.

We continuously check against the big global sanctions watchlists (UN, EU, OFAC and OFSI) for new releases, as well as monitoring locally-enforced national sanctions watchlists to match your market presence and compliance needs.

Can I work with an individual or business appearing on a sanctions list?

No. Businesses should not accept as customers, individuals or entities who are subject to financial sanctions. The US, UK, EU and other countries and international bodies apply sanctions on countries, businesses and individuals to prohibit doing business with them; these sanctions lists flag proscribed people, businesses and countries.

Sign up for more expert insight

Hear from us when we launch new research, guides and reports.