Great customer onboarding in financial services

The pandemic has accelerated changes in the way people access financial services, moving more people, more quickly into digital engagement with finance. As David Malpass, President of the World Bank Group, says, “The digital revolution has catalyzed increases in the access and use of financial services across the world, transforming ways in which people make and receive payments, borrow, and save”

These changes are accompanied by a generational shift in consumer expectations as more digital natives enter the market for financial services. Gen Z and millennials are driving 75% of the digital boom in Buy Now, Pay Later products while an astonishing 94% of cryptocurrency customers are 18-40 years old. These same consumers are more likely to see digital engagement as standard and expect the customer onboarding process for financial services to be simple and fast.

First impressions matter in business. Make sure your customer experience is smooth and secure.

Customer expectations of onboarding experience

The BAI reports that 75% of millennials surveyed would switch banks for a better mobile experience, while even non-native Gen X is opening more banking, saving and loan accounts online. A recent Salesforce survey of customer expectations found that 80% of customers now consider the experience a company provides to be as important as its products and services. While our own recent survey revealed 28% of consumers abandoned signing up for a new online account in the past 12 months because it took too long.

This presents a dilemma for regulated financial services that need to balance delivering a low-friction customer onboarding experience while simultaneously providing customer due diligence and preventing fraud. However, a great approach to customer onboarding in financial service should place identity at the centre of the customer experience, signalling a brand’s reputation as a trusted financial service, and building longer-lasting customer relationships based on trust, rather than managing a regulatory requirement.

Best practices for customer onboarding

Know your customer in financial services

Know your customer (KYC) checks are carried out by regulated businesses to verify customer identity and establish a legitimate relationship that poses no risk to the business. Checks are carried out at customer onboarding and then at key moments in the customer lifecycle. The types of financial services that must comply include, banking, credit, payments, money transfer and increasingly cryptocurrency but this varies between jurisdictions.

Compliance contributes to the fight against financial crime by preventing money laundering, avoiding doing business with sanctioned entities or politically exposed persons (PEPs), and early-stage detection and prevention of potential fraud. It also avoids the many risks that come with a failure to comply, including, financial penalties, and brand and reputation damage.

Building trust and reputation with identity

In the digital market for financial services where trust has brand value, thinking of KYC checks and identity as a feature of your customer experience makes good business sense.

The right balance of personal identifiers, identity documents, biometrics, behaviours and signals, at the right touchpoints, is an opportunity to establish reciprocal trust between the customer and financial service provider instilling a greater degree of consumer confidence from onboarding onwards. For the customer themselves, well-designed KYC checks and great customer onboarding remove barriers and deliver access to financial services, while reducing access to those who wish to abuse the system.

“In the digital market for financial services where trust has brand value, thinking of KYC checks and identity as a feature of your customer experience makes good business sense.”

Matching the risk profile of financial services

The best KYC onboarding and identity verification solutions for financial services are tailored to business needs, configured to match the risk profile of the service and built to automatically accept, decline, or refer applications, speeding up the onboarding process for legitimate customers who represent low risk.

Great customer onboarding for some financial services may involve data-driven KYC checks against a trusted data source, for others, identity proofing involving government-issued identity documents and biometrics will be the best match. For global financial services, any customer onboarding process needs to meet international regulatory requirements and adapt to changing standards and compliance needs without creating unnecessary complications or delays in customer onboarding.

Fraud is always evolving. Maximise your defence against current and future fraud.

Risk assessment and multi-layered KYC solutions

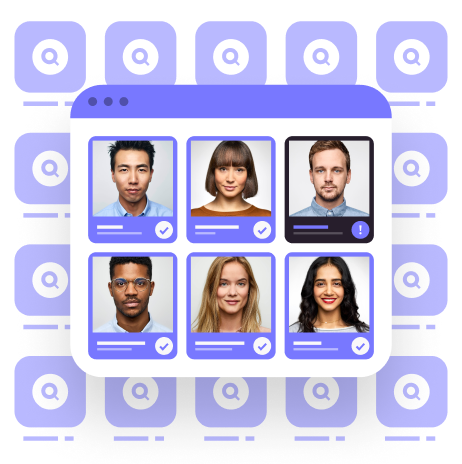

Taking a risk-based approach to KYC is an important part of ensuring customer onboarding meets global compliance standards and protects financial services from ‘bad’ customer relationships. A risk framework, including geography, financial, demographic and other key risk factors needs to be in place to drive onboarding decisions. Good KYC rarely involves binary Yes/No decisions but a level of risk assessment that informs decision-making.

Great customer onboarding solutions build in automated risk assessment, reflecting the fact that prospective customers give off low- or high-risk signals. The best KYC solutions for financial services are multi-layered, combining risk management engines that search customer risk parameters for fraud signals with accurate trust scoring algorithms, and a variety of identity data verification and identity document proofing and authenticating technologies. These solutions take visitors on customer onboarding journeys that dynamically adjust at key decisioning points based on inputs to offer greater speed and lower friction or higher security as required.

Speed and convenience matter as much as security

Speed and convenience matter as much as security for successful financial services building customer onboarding processes that inspire trust. Consumer tolerance for poor digital experience is low; we all choose whoever gives us what we want with the least hassle and the least delay. To avoid losing business, KYC customer onboarding checks must be done in a matter of minutes, without compromising compliance.

Pass more customers at speed with direct access to all three major UK credit bureaus.

While we are all in a hurry, however, well-designed KYC checks or ‘good friction’ help to build trust and brand reputation as part of a great customer onboarding experience for financial services. Indeed, as consumer awareness of identity fraud grows, research shows that biometric identity-proofing technologies can be popular with prospective customers who receive a strong signal that their identity and money are being well protected.

“Well-designed KYC checks and great customer onboarding remove barriers and deliver access to financial services, while reducing access to those who wish to abuse the system.”

Consistent multi-platform onboarding experience

Customers mix and match devices to access digital services, so digital access that varies by device is not a good look or a great experience. A great customer onboarding experience needs to be consistent across desktop, tablet and mobile, with KYC solutions that work across all platforms, giving prospective customers multiple options for onboarding as well as the ability to begin sign-up on one platform, and continue seamlessly in another.

First impressions count for digital customers of financial services. Consistent design and branding are the digital shop front for a great experience, so brands building trust and reputation do well to brand great customer onboarding their own and prefer ‘white label’ third-party KYC solutions that give them that control. Consistent performance across platforms will ensure customers feel secure submitting personal information and are satisfied with the service.

Great customer onboarding experiences should also be accessible to all, adjusting for visual impairments and other disabilities. Just as it would be wrong to exclude someone from a physical building because they are in a wheelchair, we shouldn’t exclude someone from a website or app because they have a visual or motor impairment now that we do our banking online. So, experiences should be easy-to-use and as inclusive as they can be.

Stay on top of ever-changing regulatory requirements with all-encompassing protection.

Analyse and adapt for great customer onboarding

The best customer onboarding for financial services will aim to balance simple sign-up with compliance and risk management. This is an ongoing management process and the best customer onboarding solutions will provide analytics for user experience flow.

Which devices, operating systems, browser types and screen resolutions are prospective customers predominantly using to sign up? Where are drop-off rates going up in your onboarding process and why? For global businesses, a breakdown by geography can provide insights into the performance of the localised customer onboarding experience.

Most importantly, what is your business’s customer onboarding conversion rate? How many prospects are automatically being accepted, rejected or referred for review? Identifying these performance indicators can create an improvement cycle that learns from mistakes, and continually evolves to improve customer onboarding experience and conversion.

KYC monitoring across the customer lifecycle

“Photography is truth, cinema is truth 24 times a second”, said the famous film director Jean Luc-Goddard. The image of your customer captured at onboarding is a snapshot.

Life is in motion and the customer you have today may no longer be the customer you originally signed up. Risk status will change over the customer lifecycle in response to circumstances. For example, tough times sadly lead to crimes, and an economic downturn or recession is one of the main reasons why fraud increases. UK Finance, the UK’s banking and finance trade association, calculates the year-on-year fraud increase at 14% in June 2022.

So, great customer onboarding shouldn’t be seen as a tick box exercise, discarded once initial sign up is complete. Based on the risk profile of each customer, status should be monitored and reviewed throughout the customer lifecycle for changes that could impact trust. This could include reviewing sanctions or PEP status, assessing economic circumstances or adverse media coverage for heightened risk as well as monitoring the transactions associated with that customer.

Frequently Asked Questions

What are KYC, CDD and EDD?

Know your customer (KYC) covers a range of activities to identify and verify a customer. Customer due diligence (CDD) verifies the identity of a customer and can also assign a risk profile to that customer. If the risk is higher, enhanced due diligence (EDD), is required with more in-depth research to mitigate that level of risk.

When should KYC checks happen?

As a minimum, KYC checks should happen when onboarding a new customer, or when there are changes to a customer’s situation. The most robust KYC is an ongoing process and may be required for EDD. This would include regular monitoring of typical behaviour, proportional to the risk profile of each customer, to identify and prevent possible problems.

Who is responsible for KYC?

Any financial institution beginning or changing a relationship with a customer. Among other activities, this may include opening a bank account, arranging a loan or a real estate purchase. While the business is responsible for the KYC process, the customer is also responsible for engaging fully in that process.

Who regulates KYC?

Regulation, monitoring and enforcement of KYC is conducted by many national and international bodies with their own operating jurisdictions. At a global level, The Financial Action Task Force (FATF) works with many countries to introduce and enforce standards required to fight financial crime.

Sign up for more expert insight

Hear from us when we launch new research, guides and reports.