Account Opening and Onboarding

Our account opening solutions are designed to help businesses know who they are doing business with by leveraging our award-winning technology and reliable data intelligence to verify the identity of customers accurately and seamlessly. We aim to help your customers open accounts quickly and easily, ensuring an optimal overall customer experience.

Onboard customers faster by delivering a frictionless customer experience from the first touchpoint with ‘good’ customers, while preventing identity fraud and keeping criminals out.

Trusted by over 20,000 clients in over 70 countries

Seamless digital identity verification

Check and validate your customer’s details and ID documents quickly and securely against our comprehensive library of global data sources, watchlists and government issued documents, enabling you to onboard good customers while keeping out fraudsters.

Document validation made simple

With access to a library of government issued documents, you can further verify your customers based on the required documents. Our Smart Capture technology for documents enables easy and accurate data capture to check and ensure it is genuine and has not been tampered with.

Complete onboarding faster

Document details are captured using Optical Character Recognition (OCR) technology to automatically fill in forms, minimising manual data entry errors and enabling faster document completion and customer onboarding.

Awards & Recognition

Chartis RiskTech Quadrant 2020 - AML Solutions

Recognised as Category Leader for AML Solutions

Chartis RiskTech Quadrant 2020 - KYC Solutions

Recognised as Category Leader for KYC Solutions

Chartis RiskTech 100 2021

Ranked 25th out of 100 risk technology vendors

Reliable Identity Data Verification

Reliable customer confidence

Verify your customer’s identity details quickly and accurately. With access to an unrivalled selection of comprehensive and reliable global data sources, detecting and blocking risky individuals during account opening is both simple and quick.

Document verification made simple

Smart, technology first document capture

Enhance your customer verification by letting customers capture an image of a required document using a smartphone or webcam for checking against a comprehensive library of government-issued documents. Our smart document capture technology automatically detects the optimal frame for best quality image capture.

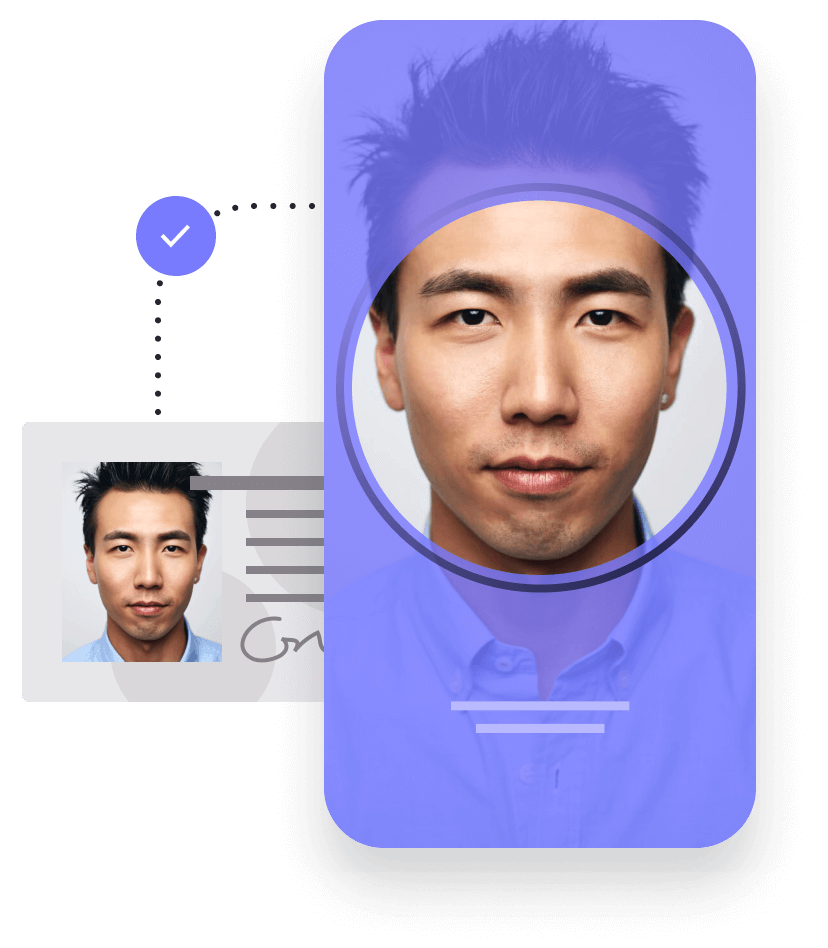

Identity Document Verification

Frictionless Facial Verification

Make sure the person on the other end of the device matches with the one on the document by leveraging our cutting-edge facial verification solution. The solution only requires the user to capture a selfie for facial biometric comparison and liveness detection in the same instance, without having to perform any gestures.

Recommended Products

Why choose GBG

We know that building trust with customers starts with ensuring their first interaction with your business is smooth, secure, and simple. Our extensive experience in the financial services and banking sectors and award-winning solutions help you deliver frictionless customer experiences from the start, establishing the groundwork for successful customer relationships and repeat customers. Our account opening solutions are designed to ensure you can quickly identify genuine customers, while preventing identity fraud and meeting compliance needs.