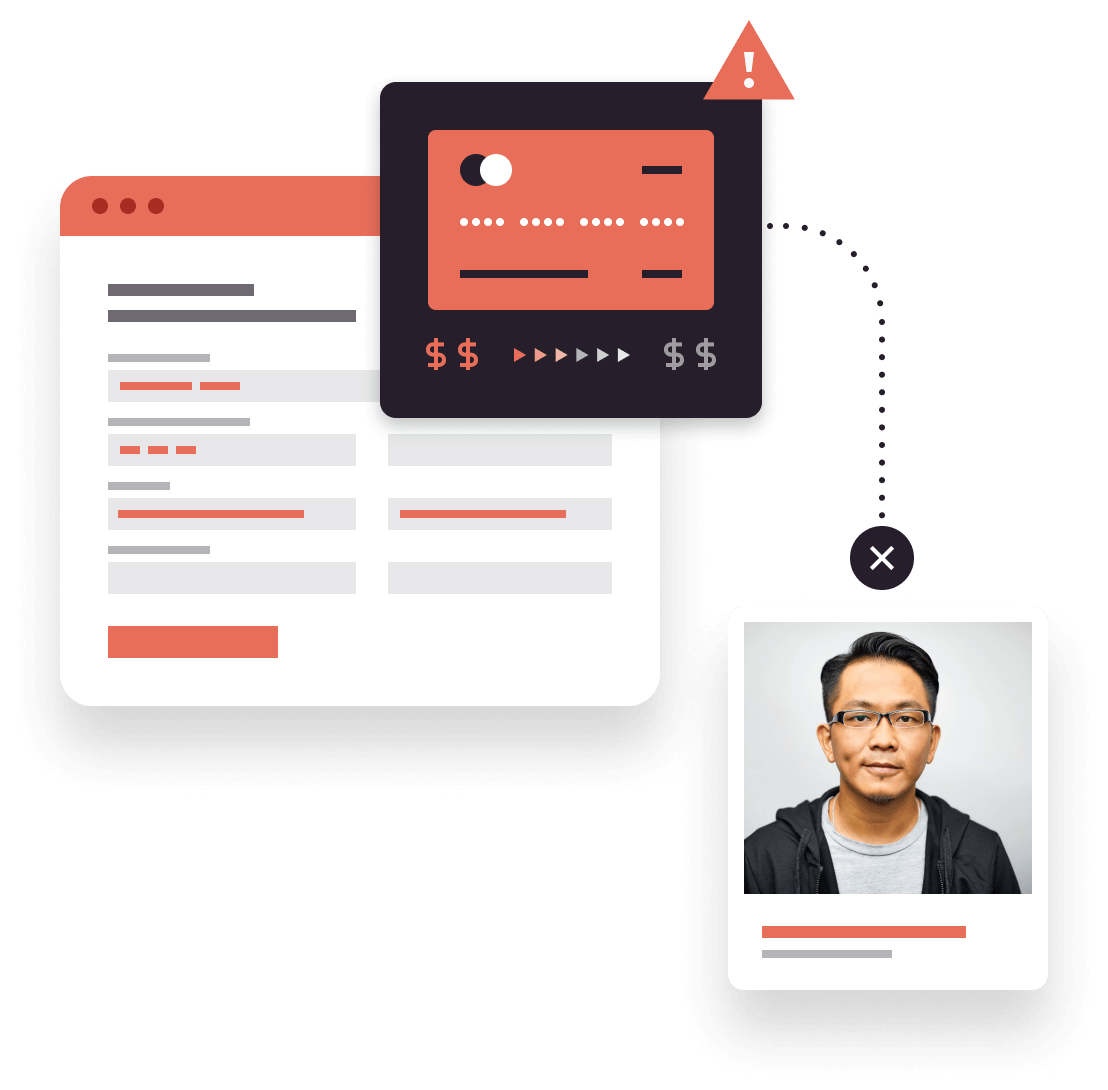

Provide quick and easy financial services customer onboarding and a cutting edge user experience without compromising on anti-fraud security and regulatory compliance with our smart solutions.

Set yourself apart from competitors with a more dynamic, frictionless and user-friendly client onboarding procedure and a superior UX.

Demonstrate your organisation is committed to financial security and build trust through the use of state of the art financial services data management techniques, document verification technology, mobile intelligence technology and AML financial services safeguards.

Onboard new customers and monitor all suspicious activity to ensure you meet all anti-fraud KYC and AML regulations.

When it comes to client onboarding in the financial services industry, speed, user experience and security are all key. Our cutting edge document verification solutions combine a selection of comprehensive techniques to ensure you provide an exceptional service while also helping to keep your business secure and compliant.

Analyse and understand any individual or organisation by visualising their identity and significant connections using the UK’s most comprehensive data.

Poor onboarding processes can cost business in the financial services industry. Our solutions use identity data verification methods that take advantage of a selection of far-reaching global data sources to ensure digital onboarding is made quick, simple and secure for you and your customers.

When it comes to client onboarding in the financial services industry, speed, user experience and security are all key. Our cutting edge document verification solutions combine a selection of comprehensive techniques to ensure you provide an exceptional service while also keeping your business secure and compliant.

Here at GBG, we understand that user experience, identity security and fraud detection are all absolutely essential in the financial services industry. In order to protect your business and provide the best possible service for your customers, our bespoke identity, fraud and location intelligence solutions can be integrated into your existing processes and are designed with the demands of the financial services sector in mind.