Identifying international customers: global solutions for growing businesses

The number of digital consumers worldwide is increasing rapidly alongside global internet access and adoption.

In 2023, 5.3 billion people, or 66% of the world’s total population, were online and growing into an ever increasing pool of prospective customers for businesses just a couple of clicks away. In the same year, global retail eCommerce sales were estimated to exceed $5.7tn and growth in the number of online purchases doesn't appear to show signs of slowing down soon, despite the macroeconomic headwinds that the global economy is currently facing.

The potential for growth in new markets is an attractive one for online businesses. New territories represent geographic diversification and a reduced risk of diminishing returns by targeting new sources of revenue generation beyond a business’s current borders. But for ambitious businesses, with internet-driven growth strategies, onboarding international customers comes with a new set of challenges…

How do you tell your good global customers from the bad risks?

Building trust in international identities

Digital identities will play a huge part in fuelling the growth of the Internet economy and opening up new international markets. Any business looking to transact globally needs to unlock data on genuine international customers in order to onboard them with trust and confidence.

“We want to make it easy for your business to identify international customers and transact with confidence around the world. Wherever your business is expanding, we’ve got you covered.”

Before onboarding new customers online, it’s important to trust that this is a real person; not a synthetic identity cooked up by a cybercriminal using fake data to create an illicit digital persona. And your business needs to be confident that this person is who they claim to be, not using a stolen identity without the genuine owner's knowledge.

Financial and property services, gaming and other regulated businesses need to trust that they can do business with a prospective international customer, screening for high-risk individuals engaging in illegal activities. They also need to make a judgement that this customer does not represent too big a risk to their business.

Learn how to unlock international customer data

For these regulated businesses, onboarding and monitoring the activity of international customers online requires customer due diligence that must comply with local rules. In many markets, these know your customer (KYC) identity checks will be informed by the same Financial Action Task Force (FATF) 40 Recommendations, but not all countries define digital identities in quite the same way or require the same identity checks.

So, onboarding journeys for international customers need to dynamically respond to local requirements – balancing great experience and security around the world.

International KYC

Regulated or not, if your business is looking to pursue global growth opportunities and get busy onboarding customers in new markets, you are going to need to access comprehensive international identity data sources and international identity document libraries you can trust.

Verifying international customer identities requires access to trusted data sets; these can include government sources, credit bureaus, and mobile operator databases. For higher-risk industries or individuals, it may also include digital identity document proofing.

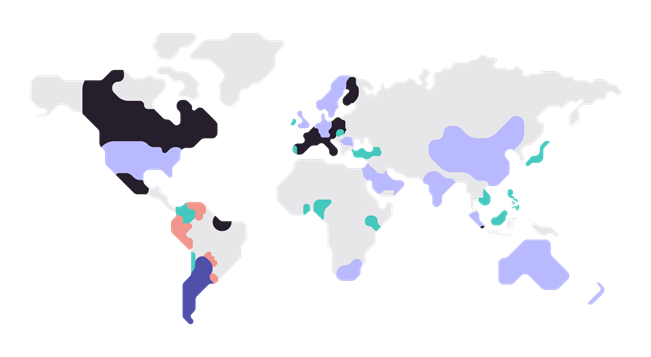

Global identity data coverage

Here at GBG, knowing our customers’ need to grow in new markets, we want to make it easy for your business to identify international customers and transact with confidence around the world. Wherever your business is expanding, we’ve got you covered.

Our enhanced international identity data coverage has now expanded to include over 50 global territories, including national identity data sets ranging from Ireland and Turkey to Indonesia, Japan and Vietnam; with Peru, Venezuela and more Latin American countries soon to follow. And as well as adding identity data for tens of millions of prospective customers in new markets to the existing territories we cover, we have enhanced identity reference data in many other markets, including, Brazil, Canada, Singapore and Switzerland.

Our global data suppliers are sourced to meet the highest compliance standards, providing breadth and depth of identity knowledge to our customers. With more identity data to reference, your business can increase match rates and achieve fast and accurate onboarding decisions, acquiring more new customers in more countries at speed.

International identity proofing

While international identity data verification offers rapid assurance where a risk-based approach permits it, best practice digital customer onboarding dynamically adjusts between data and document-centric identity verification routes, to maximise customer conversion while reducing the risk of fraud.

Deliver definitive digital identity proofing decisions in seconds

According to the latest research by the World Bank, the number of people around the world who possess an identity document is increasing. Each year, the different types of passports, national identity and social security cards, driving licences and other documents in international circulation also goes up and up.

“Our global library of government-issued ID document templates has expanded to match the growing demand for accurate identity proofing, offering more than 8,000 templates across 196 countries and territories.”

Our global library of government-issued ID document templates has expanded to match the growing demand for accurate international identity proofing, offering more than 8,000 document templates across 196 countries and territories.

Wherever in the world the level of risk in an onboarding decision demands it, your business can combine accurate document assessment, biometric authentication and liveness checks to establish the genuine presence of a new international customer.

Global identity scoring for customers

Clearly, one of the challenges facing any business looking to transact globally and onboard customers in many international markets is the sheer diversity of identity reference data and identity documents that exist in the world.

To help your business manage the complex world of international identity verification, GBG Identity Score adds up the number of identity sources and matches for both identity data and documents, as well as the integrity of the datasets in which they appear, to produce a single, globally consistent metric.

How GBG Identity Score works

GBG Identity Score provides a globally consistent metric from 0-1000 that tells you in real time how much trust you should place in a digital identity.

GBG Identity Score measures:

Identity integrity

The completeness and authority of the datasets in which the identity appears.

Identity count

The number of different datasets in which the identity appears.

Identity match degree

The level to which all data and document elements of an identity can be matched.

Here at GBG, we have poured 30+ years’ experience in digital identity verification, plus our global portfolio of identity data and our international identity document know-how into a simple green, amber or red trust signal for onboarding.

Designed to complement your existing identity verification process, GBG Identity Score delivers a more granular assessment of identity attributes to produce a global identity confidence score. Consistent and objective, GBG Score helps your business to optimise your international onboarding strategies across your product range and target markets.

Global solutions for growing businesses

Growing businesses need global solutions to safely onboard international customers. Any business looking to build its global customer base needs to have trust and confidence in the digital identities that come knocking on its door.

Whether your industry is regulated or not, a combination of comprehensive international identity reference data and multinational identity document proofing offer a global response to KYC compliance and identity verification. And with GBG Identity Score, your business now has a universal tool to help you calibrate your customer onboarding journeys, translating all of that data and all of those documents into a tangible trust metric to speed the arrival of genuine customers around the world.

Frequently Asked Questions

What is digital identity verification?

Digital identity verification is the process of proving that an identity is real without ever having to meet someone face-to-face. It helps to confirm that a person is who they say they are and that the personal information they have provided isn’t fake or stolen.

What is Know Your Customer?

Know your customer (KYC) is a requirement for regulated industries. It refers to the due diligence companies must carry out at onboarding and as part of continuous monitoring to ensure customers are genuine and do not pose an individual risk to the business.

Can I combine identity data and document verification?

An identity is made up of several different elements. By layering identity data checks, such as name, date of birth, and address, with identity document proofing your business can build up a complete picture of your customer's identity.

What is GBG Identity Score?

GBG Identity Score is a global identity confidence score. It tells you if you can trust the footprint of a customer’s digital identity. Complimentary to your existing KYC process, GBG Score is more granular than typically binary onboarding checks. Consistent and objective, scoring allows you to optimise your onboarding strategies across products, regions and segments.

Sign up for more expert insight

Hear from us when we launch new research, guides and reports.