Frictionless digital ID verification deployment is highly coveted by Australian businesses

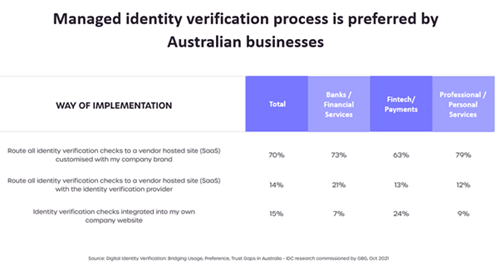

SYDNEY, AUSTRALIA. 16 November 2021: GBG (AIM:GBG), the global experts in digital identity, helping businesses prevent fraud and meet complex compliance requirements, has today released findings from its “Digital Identity Verification: Bridging Usage, Preference, Trust Gaps in Australia” market research conducted by IDC. The IDC research, commissioned by GBG, unveils a strong preference among 70% of Australian businesses to leverage managed services providers for identity verification checks, customised with their company brand. This preference is consistent across financial services, superannuation, fintech, crypto, payment, insurance, wagering, telco, and real estate industries.

A managed KYC (Know-Your-Customer) process offers the benefit of seamless digital identity verification and removes the need for businesses to spend time and resources to integrate and manage the solution themselves. 79% of telcos, gaming/wagering and real estate organisations, indicate a very high preference to use vendor hosted identity verification checks with their branding. 73% of banks and financial services indicate the same preference, while fintechs/payments organisations show a slightly lower inclination at 63%.

Digital adoption and accessibility of more digital services are driving demand for frictionless identity verification experiences

The survey of 1,502 Australian consumers and 300 financial institutions (FIs) and professional services firms found businesses in Australia increase their onboarding of new customers by 23% from 2020 to 2021. Fintech/payment companies, in particularly, have seen a 41% increase during this period. There has been a strong preference for digital channels, with 3 in 4 new customers utilising web, mobile, or apps when onboarding a new service this year. This trend is expected to grow with businesses in Australia forecasting a larger increase (26%) in new customer acquisition next year.

From the research, two-thirds (67%) of Australians had created up to six new online accounts in the last 12 months, as a result of the pandemic, to continue their access to services remotely.

Michael Araneta, AVP for IDC Financial Insights and lead analyst for the survey remarks, “Australian businesses must be able to support the sheer amount of growth in interactions with customers. This has been seen especially in customer onboarding, where the growth of new customer accounts in digital channels does not show any sign of stopping. It is important for businesses to ensure that the customer onboarding process is seamless to set the quality of customer journeys right from the get-go.”

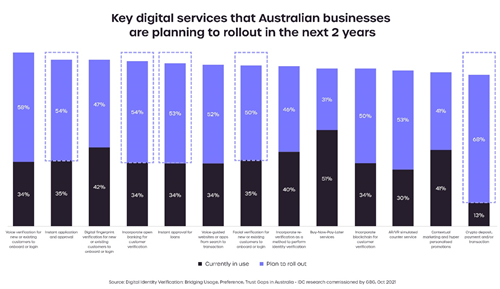

In addition to the existing online services available today, businesses in Australia are planning to roll out new digital services that would require identity verification as part of the onboarding process in the next two years. When asked which services they are planning to rollout in the next two years, more than half are planning to launch instant applications and approvals of services (54%), instant approval for loans (53%), crypto deposits, payments and transactions (68%), open banking (54%), and facial verification for new or existing customers when onboarding or logging into a service (50%).

Carol Chris, Regional General Manager of Australia and New Zealand, GBG, commented, “As Australians are signing up for more digital services every day, financial institutions need to keep pace with customer experience expectations. Most businesses recognise managed services for digital identity verification can help significantly reduce friction in their management of the KYC process, while also making it simpler to stay compliant. This is a prime and commonly overlooked business opportunity to utilise managed services to free up resources while ensuring a high standard of service and customer experience.”

“We are seeing an increase in customer enquiries to migrate the deployment of identity verification on their website to our greenID managed solution. Businesses are recalibrating to focus on developing their core competence and to utilise internal resources more effectively. The trend to entrust the identity verification process to technology specialists would accelerate,” adds Chris.

GBG hosted a webinar “Digital Identity Verification that both Customers and Businesses Trust” on 11 November, 11-12pm AEDT, where IDC presented the findings of the research.

To watch the webinar on-demand, please click here.

To find out more about the greenID hosted solution for end-to-end digital identity verification and facial biometric identity verification, please visit: www.gbg-greenid.com

About GBG: GBG (AIM: GBG) offers a range of solutions that help organisations quickly validate and verify the identity and location of their customers. Our market-leading technology, data and expertise help our customers improve digital access, deliver a seamless experience and establish trust so that they can transact quickly, safely and securely with their customers online. Headquartered in the UK and with over 1,000 team members across 16 countries, we work with 20,000 customers in over 70 countries. Some of the world’s best-known businesses rely on GBG to provide digital services and keep the economy moving, from US e-commerce giants to Asia's biggest banks and European household brands. To find out more about how we help our clients establish trust with their customers, visit www.gbgplc.com/apac, follow us on Twitter @gbgplc or LinkedIn.

- Press releases