Winning in iGaming global markets

Read our market-by-market report on the big bets in Latin America and the chance of big wins with iGaming Ontario and other Canadian provinces planning to liberalise online sports betting.

The iGaming industry is booming and among the fastest-growing sectors of the global economy, despite current macroeconomic headwinds. The betting is that the international online gambling market will top $150bn by 2031, equivalent to an annual average growth rate of 11.7%.

Many countries have recognised the popularity and economic potential of regulated gaming markets and have implemented new laws to allow operation within their borders. Savvy Operators are speculating on big wins in this global regulatory environment, pushing to be first to new markets, win new players and build their business.

“82% of Operators we surveyed for our report on iGaming in Latin America expect to win more than 10,000 new players around the world over the coming year.”

This iGaming global growth is being fuelled by a combination of increased mobile penetration, improved internet connectivity and big new regulated markets opening up around the world.

As the leading global expert in digital identity, it’s our business to ensure international Operators can win in these growing global iGaming markets. We deliver full compliance with the local gaming regulations governing identity verification, age verification and affordability, protecting your business against money laundering activity and protecting your players from gambling beyond their means.

iGaming Latin America Market-by-market report on opportunities

Game on for iGaming Ontario

With a population of over 14 million, Ontario has huge potential to be one of the big online players in global iGaming markets. Since iGaming Ontario launched in April 2022, several major brands have successfully applied for licences to operate within iGaming Ontario’s regulatory framework.

Ontario has recorded more than $6bn in online gaming since September 2022, with total gaming revenue of $267m and the chances are that these wagers will increase in 2023.

With the success of iGaming Ontario, the odds that other Canadian provinces will follow suit have also increased. Observers of the Canadian online gaming market are predicting more growth and more opportunities for Operators to open up.

Canada’s online gaming market could reach $5.8bn by 2026 if liberalisation in online sports betting goes ahead in Alberta, British Columbia, Manitoba, and Saskatchewan, according to VIXIO, the regulatory intelligence specialists.

“60% of gaming brands who hold the iGaming Ontario licence are working with us and we are excited to see where iGaming in Canada will go next.”

As with the MGA and UKGC licence, iGaming Ontario licenced Operators must comply with know your customer (KYC) and anti-money laundering (AML) requirements and carry out identity verification checks at the point of player onboarding.

As the first identity verification technology provider to deliver iGaming Ontario-compliant identity verification solutions, we are the go-to supplier for Operators who are entering into the Ontario market – 60% of gaming brands who hold the iGaming Ontario licence are working with us and we are excited to see where iGaming in Canada will go next.

On-demand webinar iGaming Ontario. Unlock opportunity and deliver compliance

Placing big bets on Latin America

For an industry built on chance, the odds seem good for iGaming. 82% of companies we surveyed for our report on iGaming in Latin America expect to win more than 10,000 new players around the world over the coming year with many placing big bets on Latin America.

Consisting of 33 countries and union territories, Latin America has a combined GDP of $5.5tn and with more than 600 million people in the region, the sheer size of the addressable market for new players makes Latin America particularly appealing for the iGaming firms looking for growth.

The iGaming market in the LATAM region reflects its diversity. Each country regards and regulates gambling differently with varying degrees of social acceptance. The market is complex but dynamic and represents a lucrative opportunity if businesses place their commercial bets effectively.

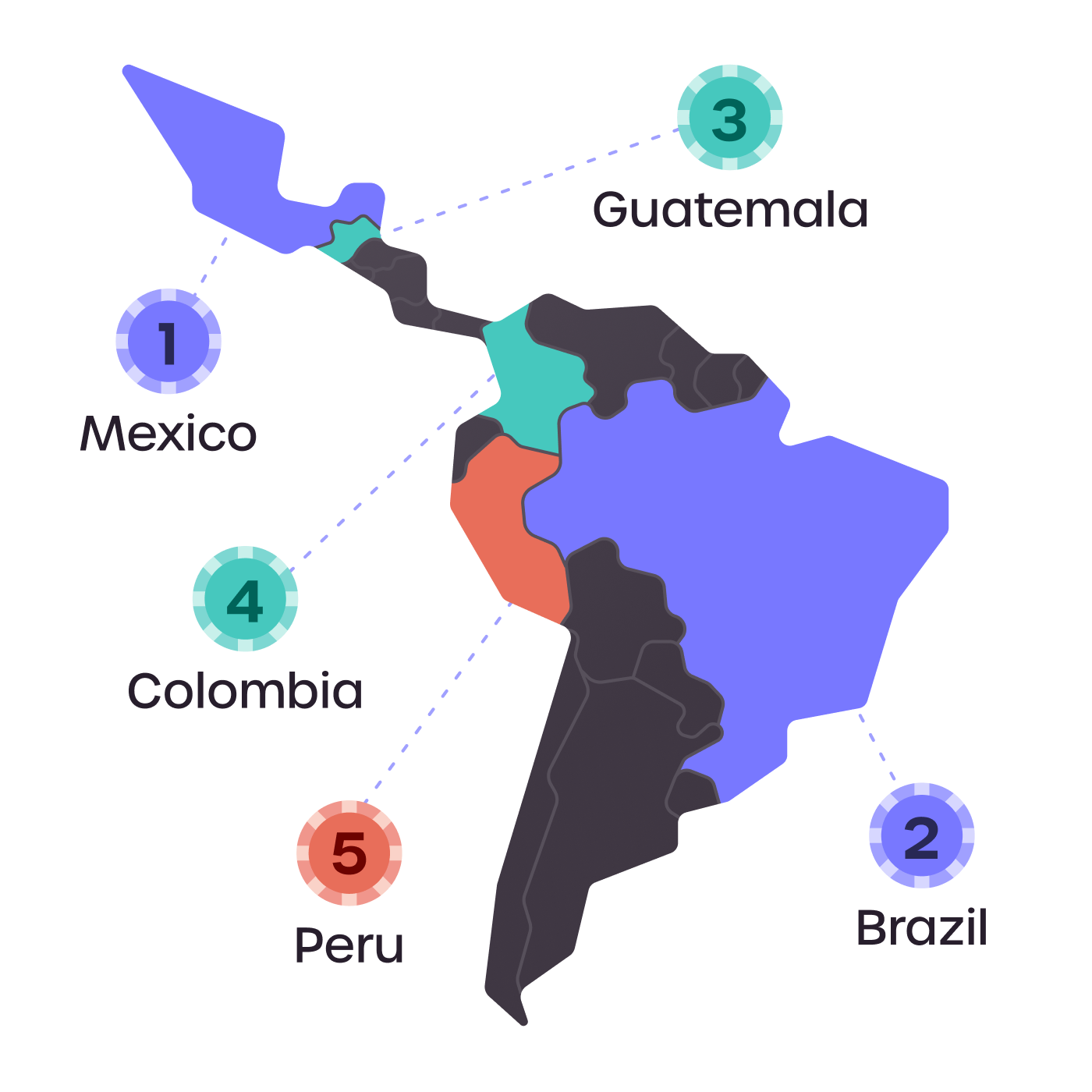

Top iGaming markets in Latin America over next five years

1. Mexico

Mexico's regulated iGaming market came online in 2018. Although relatively new, it’s currently the biggest gambling market in Latin America, so not surprising first choice for Operators.

2. Brazil

With over 200 million people, Brazil is the sleeping giant of iGaming. Most gambling is still prohibited, but with huge potential tax revenues Brazil is widely expected to regulate soon.

3. Guatemala

Although not currently regulated, there are signs that Guatemala plans to put updated iGaming regulations into play, which puts this small Central American list of top growth markets

4.Colombia

First mover in iGaming regulation in 2016, mobile penetration of 56% and over 50 million football-crazy Colombians make Latin America’s fourth-biggest economy a good bet, especially in esports.

5.Peru

As yet unregulated, Peru announced legislation in August 2022 to regulate iGaming and sports wagering, signalling opportunities for iGaming Operators will be coming online soon.

The size and scope of iGaming opportunities in these countries is highly dependent on the local regulatory regimes. In some markets the barriers to entry are still high, but regulatory changes can quickly create big wins for ambitious Operators keen to be the first movers in securing new players.

To better understand iGaming industry in LATAM, we commissioned a survey of 71 global gaming Operators from across casinos, lotteries, sports betting, fantasy and eSports businesses to produce a market-by-market report on iGaming in Latin America, the regulatory challenges opportunities.

Winning solutions for iGaming

Our award-winning iGaming and gambling identity verification solutions have strong coverage across the Americas and we’re ready to help our customers win in these growing global markets, operating safely and compliantly across the continents.

Our onboarding solutions help Operators sign up more players securely and stay on the right side of market regulations while protecting underage visitors and safeguarding players from spending more than they can afford. We make sure you can verify the identity of new players in seconds, with easy-to-complete verification and proofing no matter where in the world your visitors are located or which ID they have in their hand.

Frequently asked questions

Which Latin American countries does GBG cover?

We offer identity data and document verification across all Latin American markets. If your business is planning to place big bets on Latin America, read our market-by-market report on opportunities and player onboarding in the region and get in touch with our iGaming team.

Can GBG support iGaming Ontario licence application?

Yes, we can. 60% of gaming brands who hold the iGaming Ontario licence are working with us. If your business is applying for an operator licence, we can support you with our Canadian, FINTRAC-compliant identity verification offering the best and safest player experience.

Placing big bets on Latin America?

Read our market-by-market report on opportunities and player onboarding.