iGaming Ontario know your customer: KYC need-to-knows for operators

In 2022, a new player arrived in the regulated marketplace for iGaming and sports betting. iGaming Ontario (iGO) became Canada’s first mover in the regulated online gambling market, working with operators on behalf of the provincial regulator, the Alcohol and Gaming Commission of Ontario (AGCO).

Since the launch, 47 iGaming Ontario operators and 74 brands have gone live, generating more than 1.6 million active player accounts. Eighty-five per cent of Ontario’s players are now playing on sites that comply with AGCO rules; Ontario has won recognition as a leader in responsible gaming as well as nearly $2bn in tax revenue, a tally that rivals the biggest regulated markets for iGaming operators in North America.

Game on for iGaming Ontario

With a population of over 14 million, Ontario in Canada has the potential to be one of the biggest iGaming markets in the world.

When iGaming Ontario launched, we were the first identity verification technology supplier to deliver FINTRAC-compliant identity verification solutions. The iGO team joined our panel of compliance specialists to share how to deliver the best and safest experience for players.

Unlock opportunity and deliver compliance

Working with iGaming Ontario

Regulated iGaming and sports betting is a rare combination in North America; iGaming Ontario manages a unique route to this unique market. A subsidiary of the Alcohol and Gaming Commission of Ontario (AGCO), Ontario’s overarching regulatory body, iGO sets out to help operators provide the best experience and the safest environment for players.

iGaming Ontario works alongside operators entering the Ontario market. With no regulatory link to land-based sites, operators already active in offshore markets around the world are encouraged to register. Step by step, iGaming Ontario works together with the international industry, providing an interface to government and facilitating access for operators as private contractors to Ontario’s fast-growing iGaming and sports betting market.

“As the go-to KYC technology supplier for iGaming Ontario operators, we support many businesses in successfully entering the Ontario market. Over 60% of licenced iGaming brands are supplied by us today.”

iGaming Ontario & KYC compliance

iGaming and sports betting operators entering Ontario’s regulated market must comply with obligations set out by the Financial Transactions and Reports Analysis Centre of Canada. FINTRAC is Canada's financial intelligence unit, responsible for facilitating the detection and prevention of money laundering and financing of terrorist activities.

Operators complying with FINTRAC standards must fulfil commercial anti-money laundering (AML) obligations under Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). Just as in other regulated markets, that means your business must carry out know your customer (KYC) checks, with identity verification at the point of player registration and for some transactions.

iGaming Ontario,

KYC & identity data

Operators going to market with iGO can onboard players using identity data or document verification. Most iGaming Ontario operators will onboard players using identity credit data verification as it delivers KYC-compliant onboarding decisions in seconds.

Player identity data verification

FINTRAC-compliant digital identity data verification involves matching personal data – name, address and date of birth – against trusted Canadian credit bureau data. There are two routes to achieving a successful player data match.

FINTRAC-compliant KYC

As the leading experts in global digital identity, we were the first identity verification supplier to deliver FINTRAC-compliant identity verification for iGaming Ontario.

As the go-to KYC technology supplier for iGaming Ontario operators, we support many businesses in successfully entering the Ontario market. Over 60% of licenced iGaming operator brands are supplied by us today.

Single credit file source

The first route to achieving FINTRAC-compliant player identity data verification is with a single match to a credit file held by a Canadian credit bureau. The catch with single credit data sourcing is that this record must be at least three years old; this criteria may exclude younger, ‘thin file’ players who are otherwise old enough to play.

“With access to Equifax and TransUnion, operators can increase FINTRAC-compliant KYC matches and boost player pass rates by 10%.”

Dual credit file source

The second route to achieving FINTRAC-compliant player identity data verification is with two, Canadian credit bureau credit file matches that must each be more than six months old. These matches can come from one or more Canadian credit reference agencies.

iGaming Operators can increase their player match rates and onboard more first-time players by dual credit sourcing checks in this way.

Two Canadian credit bureaux

We are the first iGaming Ontario identity verification supplier to deliver access to two major Canadian credit reference agencies. With access to Equifax and TransUnion, operators can increase FINTRAC-compliant KYC matches and boost player pass rates by 10%.

GBG secures iGaming Ontario operator first

To complete KYC-compliant player identity data verification for iGaming Ontario, information must be retained following registration. This includes the player’s name, the name of the credit bureau(x) or identity verification supplier, the player’s credit file number(s) and the date that the KYC checks were carried out.

Age verification

Online gambling in regulated markets is restricted to individuals who have reached the legal gambling age. You must be 19 years of age or older to participate in iGaming sites and services managed by iGaming Ontario.

Preventing minors from accessing age-restricted iGaming services is essential to providing a safe gambling environment. iGaming Ontario operators must ensure robust age verification takes place alongside KYC checks to ensure that only individuals of legal age can access their services.

iGaming Ontario,

KYC & identity documents

The third route to achieving FINTRAC-compliant player identity verification is with ID. Putting identity document checks right at your front door can cause onboarding drop-off rates to rise, so ID is mostly used for verifying when data doesn’t produce a match.

Player identity document verification

The document-based approach to digital identity verification for iGaming Ontario can include current and authentic passports, driving licences and ID cards – including the Ontario Photo Card for Ontarians who do not have a driving licence. All these documents have security features that help to detect tampering or forgery.

For accurate document identity verification, your identity verification supplier must have access to a comprehensive database of identity documentation and tamper detection technology as well as facial recognition and liveness checks to authenticate that the player using the ID is who they claim to be.

To complete KYC-compliant player identity document verification for iGaming Ontario, player information must be recorded and retained. This includes the player’s name, document type, document number, the province/state or country of issue, the expiry date and the date that identity verification took place.

iGaming Ontario player onboarding

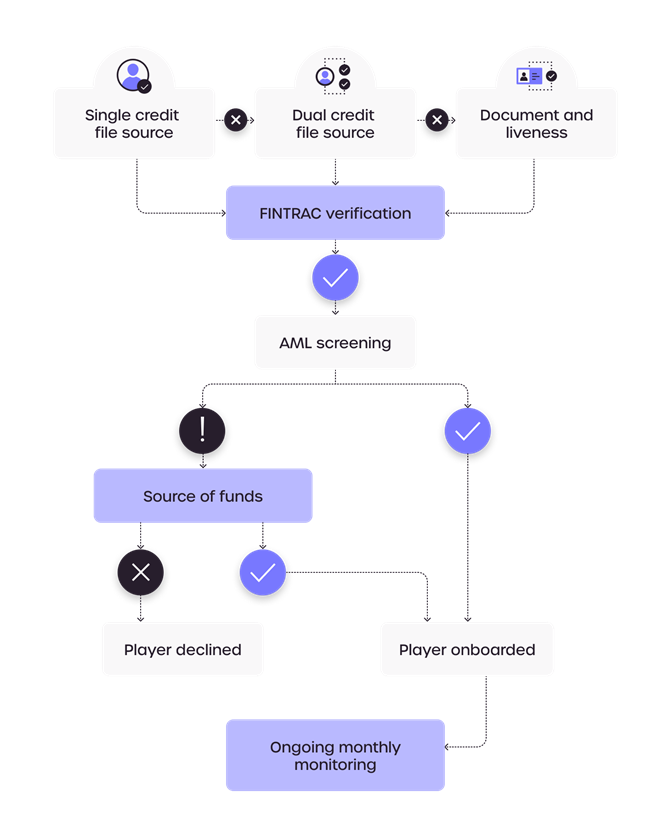

There are three successful routes to delivering iGaming Ontario FINTRAC-compliant player identity verification at onboarding.

iGaming Ontario, AML & high-risk players

In order to fulfil commercial AML obligations under Canada’s PCMLTFA legislation and avoid inadvertently abetting crime, iGaming Ontario operators are required to carry out traditional PEPs, sanctions and adverse media checks as part of FINTRAC KYC compliance at registration.

Players must be screened prior to onboarding and extended due diligence applied to establish source of funds for players who show up as high risk. Ongoing monitoring must take place at a minimum of monthly intervals and player information must be kept up to date. Your identity verification supplier should be able to automate this process.

“As global specialists in digital identity, we serve some of the top iGaming operators around the world helping them to deliver KYC compliance and responsible gambling services.”

Applying for your iGaming Ontario operator licence

Operators must enter an operating agreement with iGaming Ontario and register with AGCO before offering games to players in Ontario. iGaming Ontario provides an at-a-glance operator guide to joining the Ontario market, showing each step that prospective operators must take as well as advice on how to work with identity verification suppliers.

As the first identity verification supplier to deliver iGaming Ontario FINTRAC-compliant identity verification, over 60% of licenced iGaming operators brands are now working with GBG. As global specialists in digital identity, we serve some of the top iGaming operators around the world helping them to deliver KYC compliance and responsible gambling services.

Where next for Canadian iGaming?

With the success of iGaming Ontario, the odds that other Canadian provinces will follow suit have also increased. Observers of the Canadian online gaming market are predicting more growth and more opportunities for operators to open up.

Canada’s online gaming market could reach $5.8bn by 2026 if liberalisation in online sports betting goes ahead in Alberta, British Columbia, Manitoba and Saskatchewan, according to VIXIO, the regulatory intelligence specialists.

Where will iGaming regulation go next in Canada?

iGaming Ontario Operator FAQs

Is online gambling legal in Canada?

Ontario is currently the only province in Canada that has created a regulated framework for iGaming and sports betting. The market is regulated by the Alcohol and Gaming Commission of Ontario and managed by iGaming Ontario. With the success of the online gaming market in Ontario, however, it is likely that other Canadian provinces will follow Ontario's lead by introducing their own regulated markets.

What is iGaming Ontario?

iGaming Ontario (iGO) is a subsidiary of the Alcohol and Gaming Commission of Ontario (AGCO), the overarching regulatory body for gaming services in the Canadian province of Ontario. Set up in 2021, iGaming Ontario sets out to work with operators, helping them to deliver responsible online gambling services in a regulated market that offers both consumer choice and consumer protection.

Who regulates online gambling in Ontario?

The Alcohol and Gaming Commission of Ontario (AGCO) is the agency responsible for regulating alcohol, gaming, horse racing, and cannabis retail in the Canadian province of Ontario. AGCO became the regulator of Canada’s first regulated iGaming market when it was launched in April 2022; it determines standards and eligibility criteria for iGaming operators to enter the market and oversees the work of iGaming Ontario.

How is iGaming Ontario different from other markets?

iGaming Ontario offers regulated online gaming and sports betting and it does not limit operator licence numbers or require operators to have a business established in Canada. Popular, English language sites already operating from Gibraltar, Malta or elsewhere are encouraged to register. Those that do will discover a regulatory framework that is familiar to them as well as one of the lowest annual tax rates in the world.

What is Ontario’s approach to responsible gambling?

iGaming Ontario aims to offer a better and more responsible experience, including rigorous safeguards that protect players. Operators who are regulated in Ontario must successfully achieve and maintain responsible gambling accreditation through the Responsible Gambling Council’s RG Check program and adhere to AGCO’s Standards for Internet Gaming to ensure a high standard of responsible gambling.

Sign up for more expert insight

Hear from us when we launch new research, guides and reports.