Better mobile experience builds trust and adoption in crypto

Investing in cryptocurrencies is becoming ever more popular, especially among younger consumers. A lack of a smooth and secure mobile onboarding experience, however, can prove to be a barrier to the wider adoption of digital currencies that rely largely on digital natives for their business. With customer expectations of eCommerce at an all-time high and 80% of customers now considering the experience a company provides to be as important as the service itself, a frustrating onboarding process is a deal breaker for the average consumer of cryptocurrencies.

Increasing cryptocurrency adoption

From Bitcoin to Ethereum and beyond, there are a growing number of investment options and cryptocurrencies are increasingly a big deal. According to a recent industry analysis, there were almost 300 million global cryptocurrency owners in 2021 – an annual increase of 178%, and that number is expected to reach one billion by the end of 2022.

Cryptocurrency is most popular among younger investors. An astonishing 94% of cryptocurrency customers are 18-40 years old, with a fifth of 18-24-year-olds intending to buy into cryptocurrency for the first time in the future, along with one in six 25-34-year-olds. Only one in ten people aged between 35 and 44 are interested in investing and the level of interest continues to drop the older the demographic is.

Know exactly who is trading on your crypto exchange

Mobile KYC experience counts for crypto

During and after the pandemic, people have been accessing products and services online more than ever before. In our report on The State of Digital Identity 2022 we found that that around two-thirds of European consumers had signed up for a new online service at least once in the last 12 months. With the adoption of eCommerce and mCommerce at a high, consumers will no longer tolerate poor, confusing, or time-consuming digital services and our research shows people are more than happy to ditch one brand in favour of another that offers a better experience.

“More than a quarter of consumers said they had abandoned signing up for a new online account in the last year because it took too long.”

More than a quarter of consumers we surveyed said they had abandoned signing up for a new online account in the last year because it took too long, with around one in eight (12%) giving up because they found it too difficult. Crypto exchanges are among the targets for this frustration. When asked, only two in five consumers said it was easy to use crypto or forex services on their phone, ranking them – at best – at just half the level of digital experience offered by the best examples of digital financial services on offer.

Revolut onboards more genuine customers first time with GBG

A recent BAI demographic report on digital behaviour found that 75% of millennials surveyed would switch banks for a better mobile experience, while even non-native Gen X is opening more banking, saving and crypto accounts from a mobile device. Meanwhile, it’s clear from a comparison of the latest geographical data on global crypto adoption, published by Chainalysis, that over half of the countries in the top twenty for crypto trading are clustered in the biggest regional blocks of online and mobile banking usage, Asia and Africa.

Among the consumers we surveyed, more than three quarters had signed up to a new online account via an app or browser on their mobile device. Mobile banking onboarding was rated as ‘extremely easy’ by 47% of our survey respondents, however, only 13% thought the same of the onboarding experience for crypto and forex services. So, with an increasing number of young prospective crypto customers eager to invest, making the Know Your Customer onboarding process sufficiently slick and secure to maximise sign-up is essential.

Mobile identity for crypto onboarding

One part of the solution is already in our hands. With mobile phones now a constant presence in our lives, they have become a natural extension of our identities.

Mobile intelligence uses the mobile number of a prospective crypto customer and matches their name, address and date of birth with data held by their mobile operator. By using the mobile operator data as an identity verification source, the crypto exchange has instant access to a trusted, secure second opinion through which to authenticate the identity of a new customer within the onboarding flow or an existing customer during a transaction request.

“With mobile phones now a constant presence in our lives, they have become a natural extension of our identities.”

Arguably, a more human method of identification than the machine language of cryptographic keys, this smooth, silent and secure method of mobile identity verification is undeniably more convenient, making a virtue of a young crypto consumer’s chosen purchase platform and helping crypto exchanges onboard trusted users without unnecessary barriers.

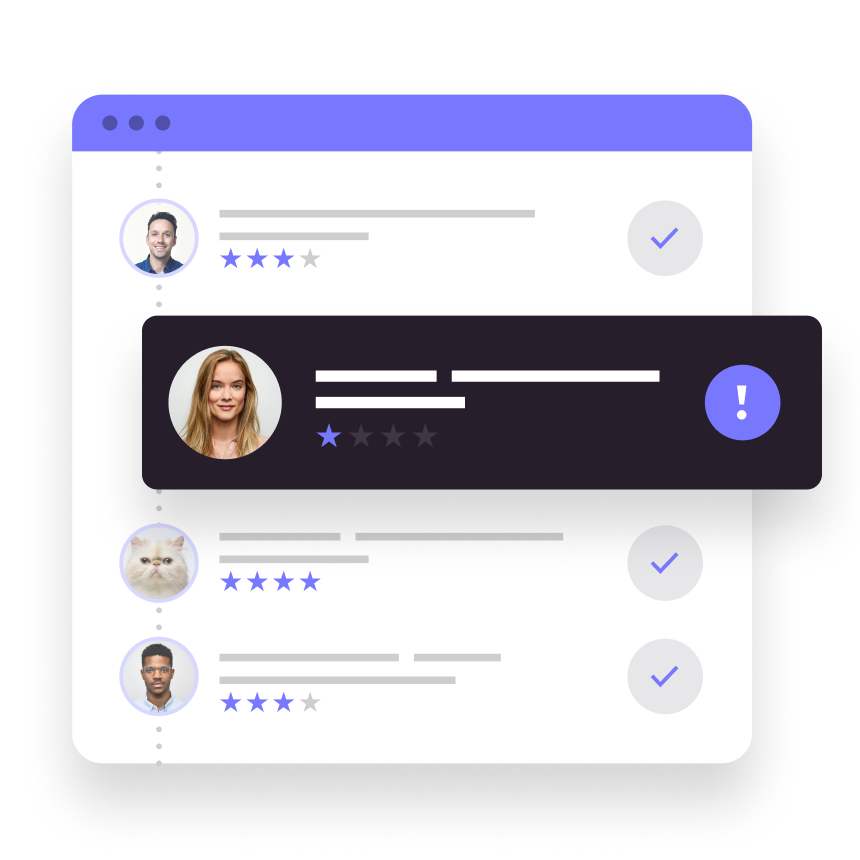

Give transaction fraud and money laundering the red flag

Building trust with crypto consumers

Helping crypto consumers transact online with ease and confidence is a balancing act but essential to building trust in a crowded crypto market where trust has big brand value.

Among the many best practices for great customer onboarding in financial services, a smooth and secure, multi-platform experience is essential, but mobile is definitely first among equals, and is primarily used by consumers when opening new accounts. Crypto exchanges should therefore make it a priority to improve the mobile onboarding experience they offer or risk losing out to competitors putting an easier way to start trading in the hands of investors.

To read our full report and gain more insights into mobile experience and mobile identity intelligence, download The State of Digital Identity 2022.

Frequently asked questions

What makes a great crypto mobile experience?

In today’s fast-paced digital world, consumers value speed and ease of use in all the interactions and transactions they carry out. Whether communicating with friends halfway across the world, purchasing goods or signing up to a service, consumers expect an intuitive mobile experience they can trust and a swift response. Crypto consumers are no different, demanding digital experience and digital currencies they can trust.

Where in the world is cryptocurrency regulated?

In October 2022, the European Union reached an initial agreement on its draft Markets in Crypto Assets (MiCA) regulation. MiCA is the first-ever crypto-specific regulatory framework; its provisions aim to protect investors while safeguarding traditional markets from the effects of crypto volatility. Read more on global regulation and the future of cryptocurrency.

How does Know Your Customer affect crypto?

Crypto exchanges such as Coinbase, Gemini, Bitpanda and others have self-regulated, performing a form of KYC checks on crypto customers at onboarding. Identity verification is important to them as part of their self-regulatory requirements. The EU Markets in Crypto Assets (MiCA) regulation is proposing to increase KYC and remove anonymity for high-value crypto transactions.

Where in the world is cryptocurrency legal tender?

El Salvador became the first country to make Bitcoin legal currency in September 2021, followed now by the Central African Republic in April this year. The legal status of Bitcoin and other altcoins (alternative coins to Bitcoin) varies substantially from country to country, while in some, the relationship remains to be properly defined or is constantly changing.

Sign up for more expert insight

Hear from us when we launch new research, guides and reports.