Identity Verification for SMEs

Verify your customers at speed with enterprise-grade compliance. GBG’s out-of-the-box solution offers all you need for your KYC and AML compliance.

Onboard more good customers

Access data from all three major UK credit bureaus to grow your business and maximise your ROI on the cost of acquisition.

Remove Friction. Reduce Abandonment Rate

Reduce customer dropouts by maximising quick ‘straight through’ onboarding and reducing the number of customers going through slower and high friction identity checks such as manual review or identity document verification.

Fraud Detection as Standard

With every identity check, we also give you GBG score for synthetic identity. Our multiple datasets gives you confidence that an identity exists and scoring helps you assess if the identity is real to help you combat fraud.

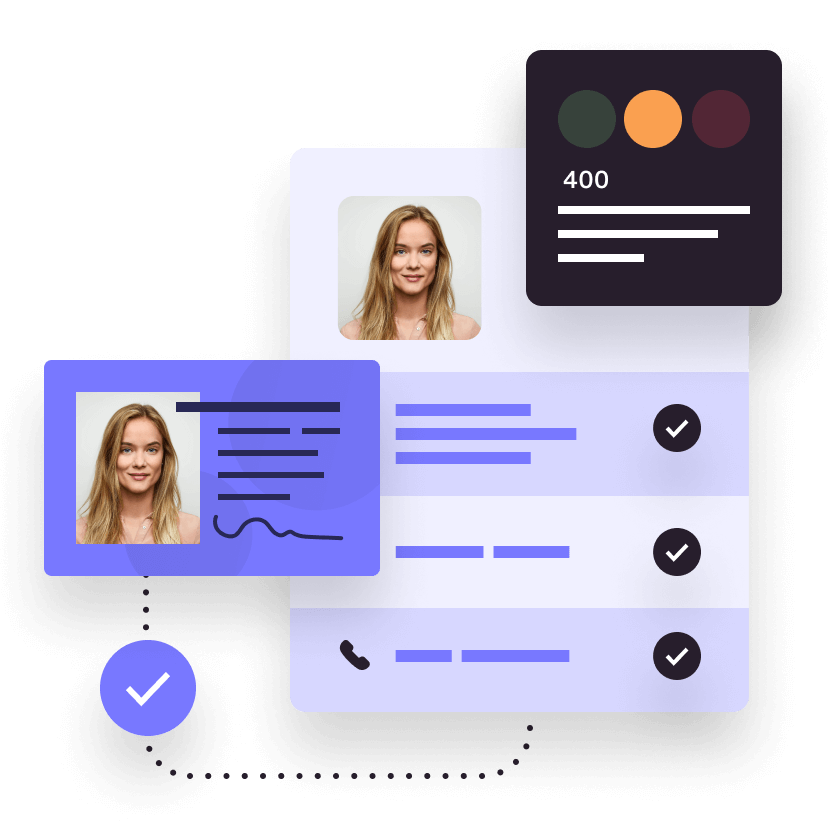

Enterprise-Grade Compliance

Simplify Budgeting. Save Cost

Out-of-the-box Solutions

We have created three packages based on our 30 years of experience serving SMEs and their compliance needs. Select a package that suits your risk-based approach.

| Feature | ID3 Lightning Essentials | ID3 Lightning KYC | ID3 Lightning AML |

|---|---|---|---|

| ID3 Platform | TRUE | TRUE | TRUE |

Multi Bureau

|

TRUE | TRUE | TRUE |

| Synthetic Identity Score | TRUE | TRUE | TRUE |

Core datasets

|

FALSE | TRUE | TRUE |

| PEPs and Sanctions | FALSE | FALSE | TRUE |