Intelligence Center

Gain access to an onboarding risk management solution with a wealth of advanced capabilities and data intelligence.

Introducing Intelligence Center for Instinct

Intelligence Centre provides access to additional capabilities and advanced data intelligence to supplement the real-time assessment and validation of applicants’ identity, geolocation, contact, device and endpoint security during the digital onboarding process. Using the Intelligence Center to orchestrate previously unleveraged data and intelligence sources significantly increases the accuracy and power of your fraud and compliance risk management.

An enhanced level of risk management

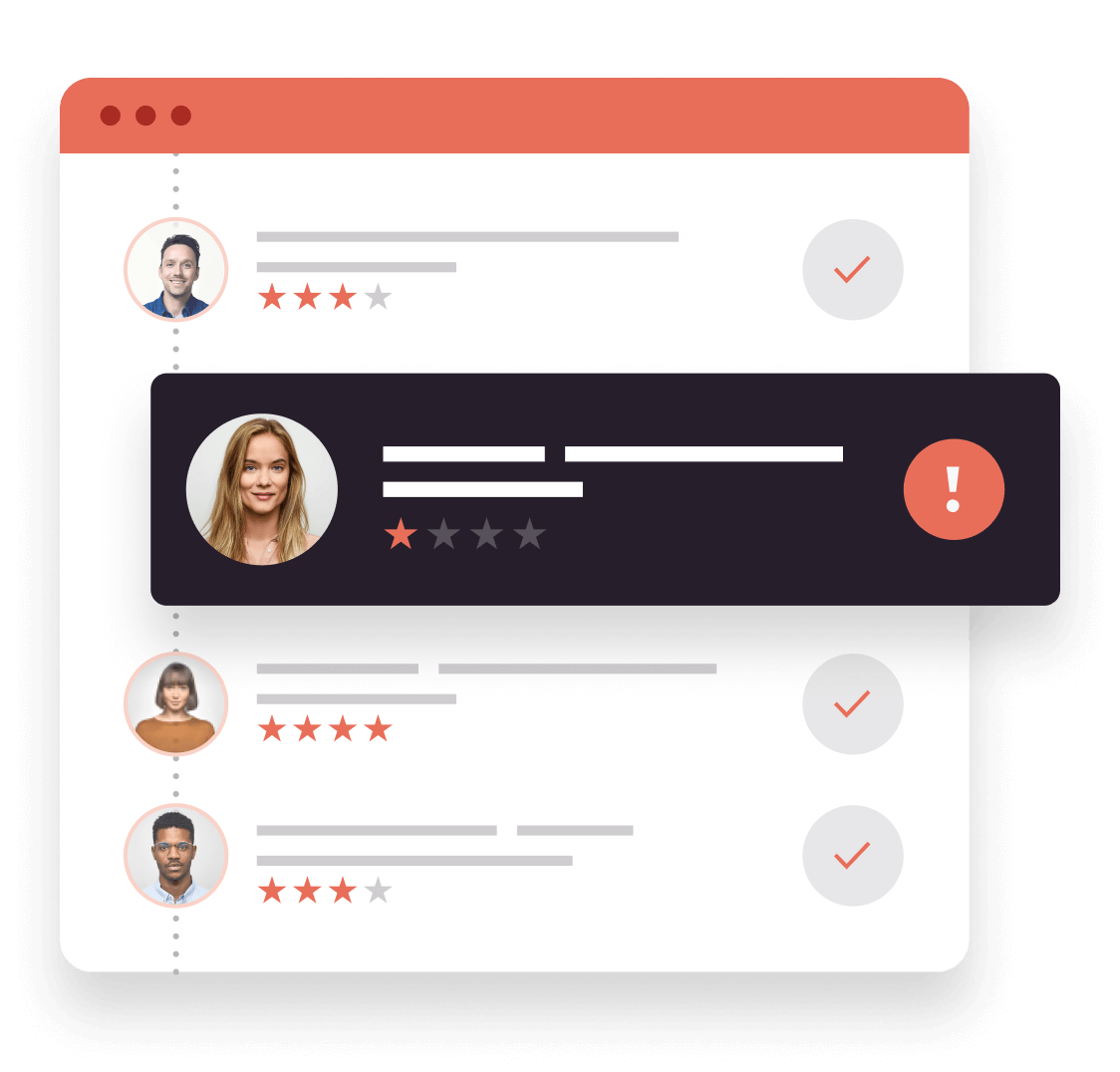

This added layer of intelligence on Instinct helps to pick up anomaly risk indicators for additional insights and enhanced defence against evolving online financial crimes.

Single click responsiveness

Adjust rules, workflows and data sources in a single click to adapt to your own fraud or changing AML, CTF and KYC regulatory requirements. Your ability to respond quickly to nuances in the financial crime landscape impacts the cost of fraud.

Leverage your ecosystem

GBG Intelligence Center unites siloed departments to create a single point of truth for each individual's profile - when you leverage a larger sample of your own data, it creates a better experience for your customers and cuts costs.

Easy on, easy off

Intelligence Center evolves with your customers and allows you to respond with speed to the changing fraud and compliance landscape. Choose to include as many, or as few, data sources as you wish in order to meet your business objectives.

Assemble your own strategy

Intelligence Center allows you to build your customer onboarding journey to meet your organisation's needs. Drag and drop workflows and inbuilt data connectors and make it easy to create and update Intelligence Center to support business strategies.

Bring your own data, or use ours

Whether your focus is on compliance management, fraud prevention, or both, our flexible solution allows you to integrate information from a number of data sets, whether they're from your own internal records, a third party source, or GBG's robust portfolio.

Intelligent KYC

Using multiple data sources strengthens your ability to verify the identities of customers during the onboarding process. It's not just about identifying potential financial crime risks - it's about recognising customers as individuals and tailoring their brand interactions to create an unforgettable experience.

Frequently asked questions

Are you an existing customer? Talk to our customer support team.