How shared intelligence helps to build consumer trust

The time when identity verification was a regulatory tick-box required to demonstrate customer due diligence is in the past. Fraud prevention is now the most important reason businesses cite for using identity verification technologies. In The Global State of Digital Identity 2023, 71% of the 500 business leaders we surveyed said they consider identity and fraud as part of a unified digital strategy.

The combined cost of identity and fraud checks is low when compared to the average cost of fraud. In its Annual Fraud Report 2023, UK Finance reveals that over £1.2bn was stolen by criminals in 2022 – equivalent to over £2,300 every minute of the year – and nearly 80% of this criminal activity originated online.

In this context, pre-emptively tackling the problem of fraud at source by making a fraud risk assessment at the point of customer onboarding and filtering out fraudulent applications makes better business sense than reacting to fraudulent in-life transactions after they have occurred.

The Global State of Digital Identity Report 2023

Trust in the global village

Building trust in a digital age of global eCommerce and remote customer relationships is more complicated than the times when everyone in the village market was familiar and business was carried out within our own networks.

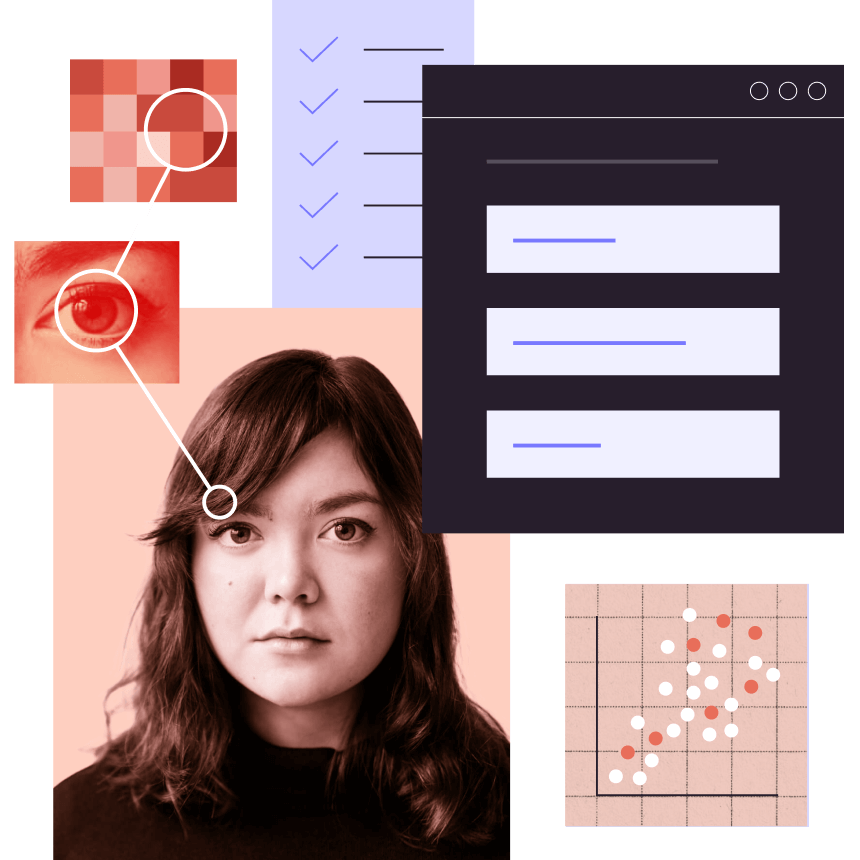

Complicating our attitudes to trust is the dynamic and increasingly complex fabric of digital identity. As our International Identity Index reveals, different regulatory jurisdictions have evolved digital identity constructs that rely more on one type of digital identity attribute than another. Much of the identity data attributes that we use online can be easily created or acquired and all of it is vulnerable to theft and criminal redistribution via cyberattacks and data breaches.

“Shared consumer intelligence is a powerful trust-building tool that creates a safer environment and online experiences for both businesses and consumers.”

Identity data networks

In a digital world that reaches out beyond the people known to us, we need identity data references that we can rely on. Data networks that offer the opportunity to share consumer intelligence between businesses can act as a new kind of digital referral system, one that can shine a light on the reputation of digital identities and identity attributes; the extent to which they are known and can be trusted.

That’s why we created the GBG Trust Network.

Shared consumer intelligence

The GBG Trust Network is a unique data network which combines millions of consumer identity data attributes contributed by a consortium of hundreds of global businesses in multiple sectors around the world. These identity attributes are derived from applications and transactions taking place across the network. Data attributes come in several categories:

- Person, e.g., forename, surname and date of birth

- Address, e.g., house/apt. name or number, street, town, postcode and country

- Device, e.g., mobile or telephone number, email and IP address

- Document, e.g., national ID number, passport or driving licence number

- Bank, e.g., account number and sort code

Privacy by design

Crucially, although consumer intelligence – trust insights or fraud signals derived from the data – is shared, the data itself is not.

Although the network contains millions of data records derived from consumer interactions and transactions taking place beyond your own business, complete data privacy is preserved. No data is disclosed to network participants that is not already known and no indication of the origin of data records is ever revealed.

The GBG Trust Network

Multi-sector network

The power of the Trust Network is in the combined cross-sector intelligence of more than 400 global businesses representing 23 different sectors: principal among these, the banking and lending, gaming, retail, insurance and fintech sectors.

Global coverage

The Trust Network connects transactions taking place in over 80 countries around the world, sharing international consumer intelligence between businesses operating in today’s borderless economy.

Transaction records and data entities

Based on current figures, the Trust Network contains over 45 million transaction records* and more than 90 million data entities and these are growing all the time.

A transaction record is a set of consumer identity data attributes submitted in a single transaction. These transaction records typically include a combination of identity data attributes, such as, name, address, date of birth, home or mobile number, email and maybe also bank details or identity document number. depending on the type of transaction.

A data entity is a combination of the same consumer identity data attributes matched across more than one transaction.

*Since its inception in April 2023, the Trust Network has grown exponentially and this figure is expected to exceed 70 million by April 2024.

Powerful insights from millions of global customer transactions

Since the inception of the Trust Network in April 2023, the number of data records contained has increased exponentially and is expected to exceed 70 million by the end of the first year.

“In a digital world that reaches out beyond the people known to us, we need identity data references that we can rely on.”

Rules

Powerful rules are constantly interrogating the consumer data records contained in the Trust Network, assessing data integrity and looking for trusted matches and combinations as well as suspicious velocity and anomalies present.

These rules can be configured to inspect data records in a single business (your own business data), one business sector or across the whole network.

Positive data matches and combinations

Rules can reveal positive matches and combinations of identity data, such as, address, email and mobile number to indicate a low level of risk associated with that identity within the Trust Network. This is even more powerful when combined with matching insights of identity confidence delivered by the GBG Identity Score.

- Match rules indicate that the data exists in the network.

- Combination rules indicate groupings of data entities: data attributes present in the same combination in more than one data record.

Suspicious data signals

Meanwhile, those same rules are roaming the Trust Network in search of signs of suspicious data patterns or activity. This could include data inconsistencies, for example, a mobile number connected to several people at different addresses; data manipulation, such as, the same identity at the same address with different dates of birth; or signs of high-velocity data deployment, for example, multiple applications submitted over a short time period.

- Anomaly rules indicate data inconsistencies or manipulation in the network.

- Velocity rules indicate high velocity data deployment in the network, e.g., the same person submitted over seven times in seven days.

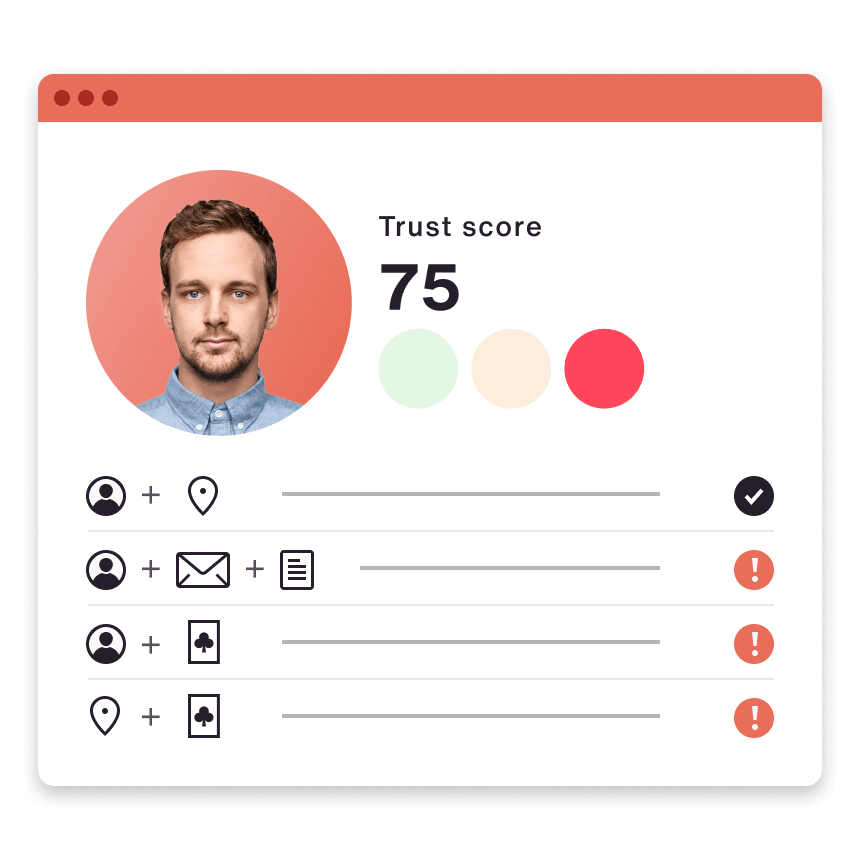

GBG Trust Score

Powerful trust and fraud insights are made possible by rules revealing positive consumer data matches or spotting suspicious data signals in the Trust Network.

Trust Score

A Trust Score of between 0 and 1000 is calculated based on the presence of positive matches and combinations or suspicious data anomalies or velocity. For complete transparency, all rules triggered to produce the score can be reviewed.

Score ranges

Score ranges indicate a low, medium or high trust result, or a zero score indicates no linked data within the Trust Network. These ranges can be adjusted to suit a business’ risk policy and the score optimised to meet business needs.

Trusted consumer insights from beyond your business

How shared intelligence builds consumer trust

Shared consumer intelligence is a powerful trust-building tool that creates a safer environment and online experiences for both businesses and consumers. Both are better protected from fraud and financial loss and everyone benefits from a better relationship based on mutual confidence.

Solutions, like the GBG Trust Network are built to preserve consumer privacy; ensuring consumer data records and the origin of those records are never shared, only the insights and intelligence derived from the data. In this way, the rights of individuals and their data privacy are protected.

Let’s look at a couple of real, anonymised examples.

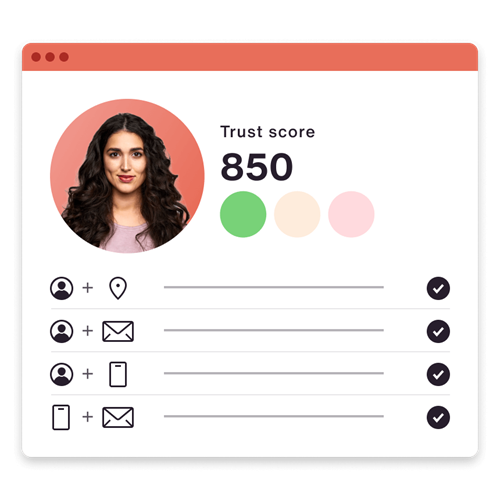

Trustworthy Mrs B.

Mrs B. is a real example of a high Trust Score achieved in the Trust Network. The buy now pay later service Mrs B. applied to could be confident she is who she says she is and quickly onboard her to the business without the need to request further identity proofing to meet fraud risk thresholds. This streamlined experience benefits both Mrs B. and the business.

Network matches

- Person + DOB

- Document Number

- Email

- Mobile

Network combinations

- Person + address (multiple)

- Person + email (multiple)

- Person + mobile (multiple)

- Mobile + email (multiple)

Positive matches and combinations

Mrs B. achieved several matches with multiple data attributes in the Trust Network, as well as several entities (combinations of data attributes) with more than one business sharing consumer intelligence in the Trust Network. Levels of data velocity in the network were normal and no significant data inconsistencies were discovered.

“Powerful consumer trust insights are made possible from the presence of positive data matches or suspicious anomalies in the network while preserving complete data privacy.”

Suspicious Mr C.

Mr C. is a real example of a low Trust Score in the Trust Network.

When Mr C. first popped up on a gaming website creating a single record with no matches anywhere in the network, he was unknown and achieved a zero score.

Not for long, however Mr C. went on to create multiple accounts in a flurry of applications, each time making subtle identity data changes. Within a few months, he attempted over 3000 applications with 18 companies and had associated himself with five different addresses, subtle changes in name, address, date of birth and contact details.

Network anomaly signals

- Same person different address within 7 days

- Multiple same person + address + different DOB

- Multiple same mobile + different person and address

- Multiple same email + different person and address

Network velocity signals

- Person + address (multiple)

- Person + email (multiple)

- Person + mobile (multiple)

- Mobile + email (multiple)

Data validation anomaly

- Middle name contains no vowels

Mr C. appeared to be a bonus abuser; fraudulently taking advantage of free spins and introductory offers in the gaming and financial services industry by pretending to be a different customer each time.

The Trust Network immediately flagged this behaviour and Mr C. began generating a very low Trust Score. Network rules were identifying suspicious anomalies and velocity within the original gaming company. Meanwhile, this real-time shared consumer intelligence was alerting other gaming companies as well financial services present in the Trust Network to Mr C’s duplicitous tactics.

Suspicious anomalies

Serial scam artists will often avoid giving their real address, attempting to use a post office box or subtle variations of their real address. In the Mr C. case, The Trust Network was able to help affiliated businesses identify the address permutations he was submitting as suspicious and unlikely to represent a genuine new customer.

Suspicious velocity

MR C’s prolific application activity also set off high-velocity data deployment alerts in the network. This suspicious data signal was first triggered when high velocity was detected over seven days in the first month of his operation and quickly this grew to 47 instances across three different businesses in the Trust Network.

Frequently Asked Questions

What is the GBG Trust Network?

The GBG Trust Network is a unique data network combining millions of consumer attributes gathered from a cross-sectoral consortium of hundreds of global businesses. Powerful consumer trust insights are made possible from the presence of positive data matches or suspicious anomalies in the network while preserving complete data privacy.

What is the GBG Trust Score?

Powerful rules constantly interrogate the consumer data in the GBG Trust Network looking for trusted matches and combinations, or signs of suspicious anomalies or activity to produce a Trust Score between 0 and 1000; the higher the score, the greater the confidence in that identity.

What is Mobile Intelligence?

Mobile Intelligence silently authenticates your customer's digital identity by matching the individual to their mobile device and delivering the extra confidence that you are dealing with a real identity and a legitimate customer.

What is synthetic identity fraud?

Among the fastest-growing financial crimes worldwide, synthetic identity fraud involves the creation of a fake digital identity that combines real identity data, such as a social security number, with fabricated information which is then used to pass identity checks and illicitly obtain goods or services.

Sign up for more expert insight

Hear from us when we launch new research, guides and reports.