Know Your Customer (KYC)

Satisfy regulators without adding unwanted friction for customers using our powerful, easy-to-integrate KYC solutions that can be configured for any risk management requirement.

Comprehensive data sources

Our extensive range of global data sources helps you adhere to the most stringent regulations and verify customer identities accurately to prevent identity theft and reduce financial crime.

Operational efficiency with automated processes

Leverage automated reviews against reliable data sources and effectively process new accounts or service applications without compromising on fraud risk and compliance with our best practice rule-based systems.

Smooth customer experiences

Maintain compliance without complicating the customer experience or lengthening onboarding processes.

Awards & Recognition

Chartis RiskTech Quadrant 2020 - AML Solutions

Recognised as Category Leader for AML Solutions

Chartis RiskTech Quadrant 2020 - KYC Solutions

Recognised as Category Leader for KYC Solutions

Forrester Now Tech Report - Large-size APAC EFM Provider 2020

Listed as Enterprise Fraud Management player in Forrester Now Tech APAC, Q4 2020 Report

Universal compliance

Meet global regulatory requirements

Adapt to changing standards and compliance needs in the markets you service without having to constantly re-engineer your processes, and easily meet industry regulations when entering new markets.

Customisable and configurable

Tailored solutions for your business

Our configurable solutions support various risk profiles, which can be set to automatically accept, decline, and refer decisions. Our KYC solutions can be flexibly configured to your business needs and regulatory requirements.

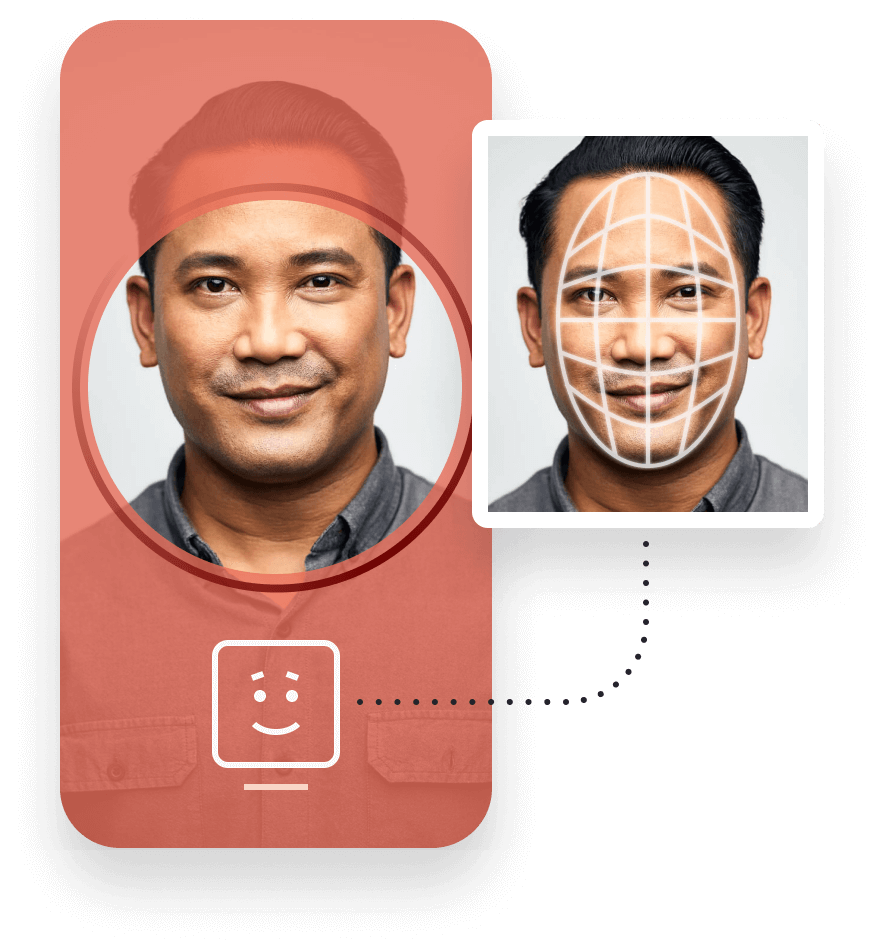

Biometric identity verification

Seamless facial biometric and liveness checks against ID documents

We use the latest technologies to help you strengthen due diligence, ensuring your customers are who they say they are by verifying their captured selfie digitally against the present photo ID in real-time.

Why choose GBG

Here at GBG, we make the data verification process as simple as possible for your business. Regardless of your industry or location, our solutions can be implemented quickly to ensure your business’ verification processes operate seamlessly, allowing you to focus on what matters - running your business.

Powerful global verification solutions that help you to deliver first-class online experiences and verify the identity of almost anyone, anywhere in the world, at any time.

Use cases for every challenge

Trusted by over 20,000 clients in over 70 countries.

What our customers are saying

With GBG our customers have peace of mind. It’s essential that we continue to use technology that keeps up with the rate of innovation to stay ahead of the competition

Get in touch

Find out more about how your business could benefit from our fraud and compliance service.