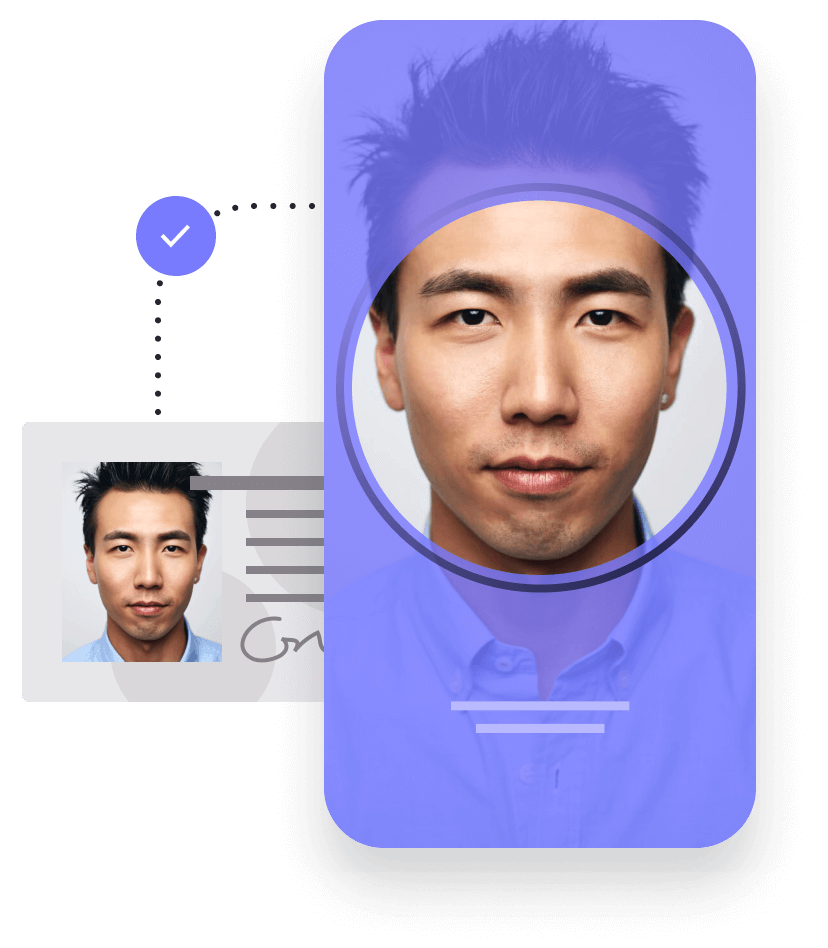

Know Your Customer (KYC)

Comply with KYC regulations with quick and easy identification verification, that is fully configurable to your risk-based approach.

Meet your global KYC requirements

Identity verification is crucial when onboarding new customers. If you fail to do the necessary due diligence, you leave yourself open to a host of risks, including fraud, reputational damage and compliance failure.

ID3global’s Know Your Customer solution layers global data sources, includes PEPs and Sanctions screening and as it is fully digital it empowers you to perform ID verification in real time from anywhere in the world.

Worldwide data sources

ID3global grants you access to data sources from around the globe. So no matter where your clients are located, you can carry out quick and comprehensive checks to confirm that they are who they say they are. Taking this step will help you to adhere to the most stringent standards.

Full screening

Beyond basic identity verification, our software can run a comprehensive suite of screening checks, including international PEPs and Sanctions checks, to help you ascertain and manage the risks associated with each individual you onboard.

Fast Anti-Money Laundering (AML) checks

With ID3global, our KYC capability can be complemented by automated Anti-Money Laundering checks. Make onboarding slicker and speedier with automated AML checks that are designed to safeguard your business against this complex financial crime and ensure regulatory compliance.

Configurable

This solution can be configured to your organisation’s precise needs. An audit trail is also kept for regulated industries, which can assist with showing why decisions were made.

Convenient API integration

Our KYC verification solution seamlessly integrates with your existing systems and applications for a truly user-friendly experience. Our API-driven solution helps to drive efficiency, improve the flow of information and speed up the onboarding process.

Frequently asked questions

Are you an existing customer? Talk to our customer support team.

We cover 38 different countries and 5 regions with the greatest breadth and depth of in-country identity verification data. You can see our full coverage here.

Know Your Customer (KYC) is an important step in building trust with your customers. KYC checks help organisations to understand and manage potential risks during the onboarding process.

All of our identity verification checks are available through a web-based solution or an integrated API.

More data verification capabilities & features

Get in touch

Find out more about how your business could benefit from our identity verification service.