Identity data verification ensures you know exactly who you’re dealing with. Verify customer identities quickly, securely and compliantly while protecting your business against fraud.

Our data-oriented digital identity verification solution gives your business access to a selection of comprehensive global data sources. Run rigorous identity verification checks no matter where an individual is located and onboard good customers first time round whilst preventing fraud and meeting compliance regulations.

Configure our identity data verification solutions to fit the specific needs and requirements of your business. Set your own rules to allow the solution to automatically decide who is safe to onboard based on your own approach to risk.

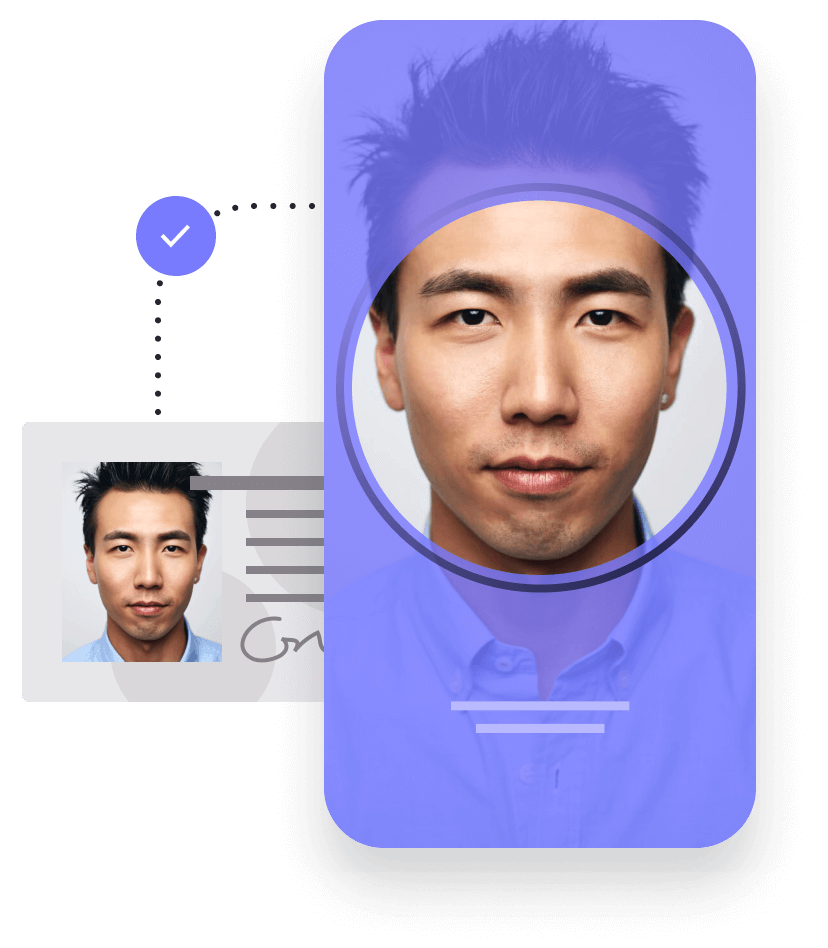

Identify fraudsters at the point of onboarding through innovative identity data sets, such as bank account verification, biometric checks, mobile intelligence and online document verification to ensure you’re only onboarding customers you can trust.

Verify the identity of the person on the other side of the screen seamlessly with automated KYC checks to ensure only trusted, ‘genuine’ customers are onboarded. Our fully configurable, risk-based solution also makes sure your business is complying with KYC regulations.

Automate your AML security processes and comply with global regulations without impacting customer experience. Our identity data verification solution protects you against money laundering and makes complying with all legal procedures and regulations simple, protecting you and your customers.

Detect potential threats - including high-risk PEPs and sanctioned individuals/organisations - early and ensure compliance expectations are met. All customers are screened at the point of onboarding, with details checked against numerous global databases which are updated daily.

Use mobile operator data as an extra layer of identity verification and fraud prevention. A mobile number often stays with a person longer than their address, knowing that a person is the owner of that number is a robust way of validating an identity and preventing synthetic identity fraud.

Verify the identities of individuals quickly and complete verification checks with ease, no matter where in the world they are located and what they use as a form of identity. Our solution is fast, safe and ensures you stay compliant with global regulations.

Working with GBG has made a huge difference to our bottom line. Great match rates, keen pricing, reliable service and fantastic account management: GBG nails all of those and that’s why it is now our preferred provider.