Businesses that try to create convenient experiences through frictionless customer journeys may have misunderstood some of their customers’ expectations. Some customers are actually more concerned about trust and security than they are about speed and everything happening behind the scenes.

It is the combination of speed, trust and security that drives convenience and a customer’s choice to transact– according to new GBG research.

The mismatch of attitudes to friction in the customer experience – The Friction Fracture - is creating a crisis of confidence that leaves consumers reluctant to sign up for services and businesses unsure of which customers to trust.

The reality is: today’s customers not only accept some friction but want it – if it serves to create a sense of security and control. And businesses that are willing to reframe their thinking on friction can better serve these customers without compromising their onboarding experiences.

What’s more, a new approach to friction can establish a line of defence against criminals as identity fraud continues to increase and evolve.

So, can businesses strike a balance between convenience for customers and protection against fraud? And how much convenience are consumers willing to trade in return for security?

This report will set out the research behind the Friction Fracture theory, exposing the scale and implications of the problem before setting out new ways of thinking about friction and how documents could be the key to fixing the fracture.

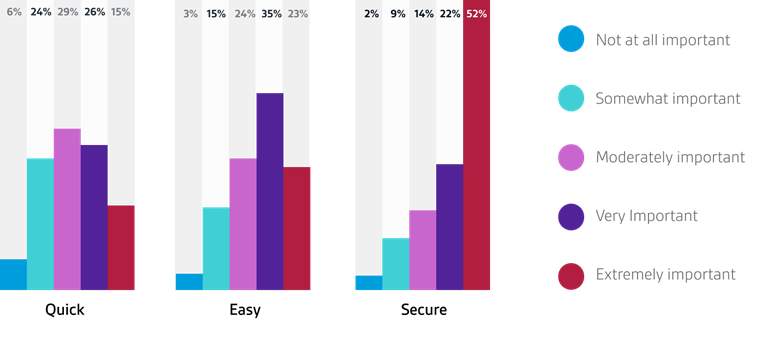

Attitudes to security and fraud

Consumers were asked to rate the importance of the following when opening a new account online:

Ultimately, businesses would better meet their customers’ experience needs by optimising friction to instil a sense of security, rather than eliminating or minimising friction for convenience alone.

Or, as Gartner analysts put it in their September 2020 Market Guide for Identity Proofing and Affirmation:

“Security and risk management leaders must balance assurance needs with friction in the customer journey, while orchestrating multiple tools and becoming aware of accuracy and bias.”

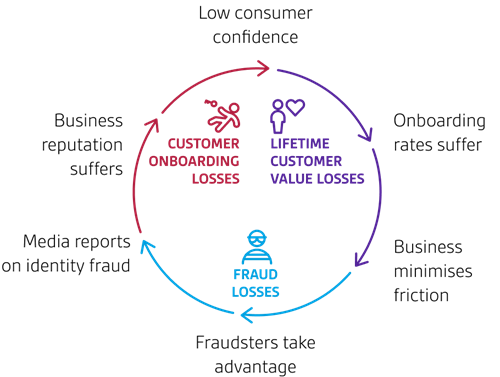

The Fraud Fracture costs consumers and businesses in several ways.

Lifetime value

Businesses creating frictionless experiences think they’re making it easier for consumers to transact by removing barriers between consumer and consumption – but to a customer worried about data security and fraud, these too-good-to-be-true experiences can feel flimsy and further damage an increasingly shaky level of confidence.

Sector Spotlight

For example, our research found almost a third (31%) of consumers feel the gambling sector doesn’t take identity verification seriously.

As members of a regulated market, gambling operators and organisations must take these things seriously or they risk losing their licences, but the focus they’ve put on making verification as frictionless as possible has potentially left customers with the wrong impression and weakened consumer confidence.

While not suitable for all demographics, operators should be looking to use the best experience for each age group.

Fraud losses

When you ask customers to jump through fewer hoops before they can sign up for a service, make a deposit or buy a product, you’re also making life easier for fraudsters looking to open fraudulent accounts – ultimately making fraud losses more likely.

Over half (51%) of those we polled in financial services said that fraud attempts are on the rise, potentially costing between an average of £1,000 and £4,999 per attempt.

The whole thing then comes full circle when fraudsters exploit these friction-free experiences because identity theft stories and data breaches end up in the media - harming the reputations of the organisations involved and further diminishing consumer confidence.

Sector spotlight: Fintech

Fintech companies are laser-focussed on using the latest technology to make things more convenient for customers, and they’re unburdened by legacy processes and systems. They hope to steal market share away from traditional financial services businesses by offering simpler, more intuitive experiences.

But no matter how slick an experience they provide, fintechs have a challenge around trust. Since their brands aren’t as widely recognised as traditional financial services firms – some of which have been around for decades or even centuries and spent huge sums of money on marketing – they haven’t earned yet earned the public’s trust.

This makes it even more difficult for fintechs to win over under-confident consumers who might see frictionless customer experiences as lacking in security.

In its 2019 Global FinTech Adoption Index, EY reported that 33% of fintech adopters say they would first turn to another organization when considering a new financial services product.

Organisations can overcome these challenges if they reframe the way they think about friction to better align with consumer needs.

In an uncertain world, trust is key. To build trust you need a good customer experience, and that means harnessing/introducing friction to deliver a feeling of control and security.

Our research tells us that for some goods and services friction is a necessary part of a good customer experience, provided it gives customers confidence that the process is secure. In other words, optimising friction according to your customers’ needs is more important than eliminating friction.

The term friction as it relates to customer experience may be too broad. Asking a customer to manually fill in a form and inviting them to tap an RFID-enabled identity document against their device for NFC extraction are both types of friction – but they require very different effort from the user, and different customers may be more accepting of one that the other.

Consumers still feel more comfortable filling in forms manually. The sense of control and agency over the process builds their confidence and trust. But in a world with keylogging malware and users prone to input errors, this presents a challenge to businesses.

But users’ attitudes can be changed, and their trust can be earned. Apple added biometrics to its iPhones at a time when users were more familiar with using traditional passcodes than their fingerprints or faces to unlock their devices. With great UX design and customer-centric implementation, however, they quickly acclimatised users to a new way of doing things.

For example, asking a user to upload an image of an identity document can create different levels of friction depending on implementation and user experience.

If you asked someone to manually take a photograph of a document before uploading it, you may find the image isn’t adequately aligned, lit or visible – and you'd have to asked them to take another. This poorly implemented friction creates a frustrating user experience.

But if you used technology that automatically captured the document when it was in the right position, and offered real-time feedback to help users get the best quality image, they wouldn’t have to submit repeated attempts until they got it right. This kind of friction creates a positive user experience.

Using documents to earn trust. Document verification involves customer interaction that can give consumers and businesses greater confidence in each other.

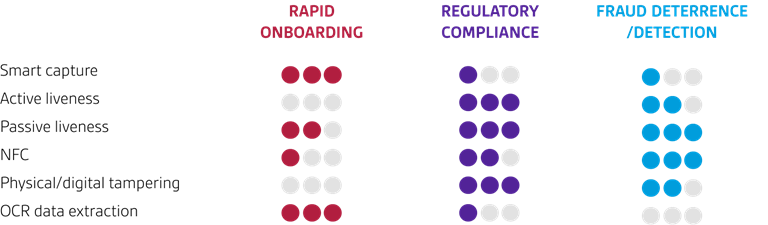

Using technologies like Smart Capture, Optical Character Recognition (OCR), Liveness and Near Field Communication (NFC), you can assure consumers that your onboarding process is secure while assuring yourself you can trust those you onboard.

And you can configure and layer these technologies according to your customers’ attitudes to friction. For example, giving older people the option to manually fill in forms while allowing younger people to take the OCR or NFC routes. You can also apply different levels of scrutiny to an identity to products that carry different levels of risk.

The table below shows how the technologies compare in terms of friendly friction, and their abilities to detect and deter fraud.

Find out more

There’s already trend towards using documents to better serve customers. According to Gartner, 80% of organizations will be using document-centric identity proofing as part of their onboarding workflows by 2022, which is an increase from approximately 30% today.

To find out more about using document verification technologies to achieve a better balance convenience and trust with your customers, click here.