Balancing consumer expectations and business imperatives in another fast-moving year for the digital economy.

By Nick Brown, Group Managing Director

The acceleration of digitalisation in all businesses globally continued at pace in 2021. From Amazon to Zalando, the shift to transacting online has simplified consumer experience, but it has also created a world of new opportunities for online fraudsters, and new challenges for regulators who struggle to keep pace with technology and innovation.

In 2021, we at GBG continued to build trust across the digital commerce lifecycle. We have added new customers, new capabilities, and greater resilience in all our products, and acquired extended capability with our acquisition of Acuant in November. It’s been a transformative year for GBG.

Location intelligence

In June, we launched the next generation of our market-leading Loqate solution, adding machine learning and predictive addressing capability, effectively self-learning “hard-to-find” locations and speeding up the shopping experience. We’ve seen research confirming inaccurate or incomplete addresses are a growing problem for businesses, causing delays in 41% of deliveries and failure in 39%. As consumers order more online across the world, Loqate’s capability adds a crucial component in the logistics cycle: making sure that consumers receive the items they need when they need them, and of course, location intelligence is also about recognising misleading addresses as an important indicator in fraud detection.

Our Loqate business has seen strong growth in customers and revenues and we look forward to even greater progress in 2022.

Identity verification

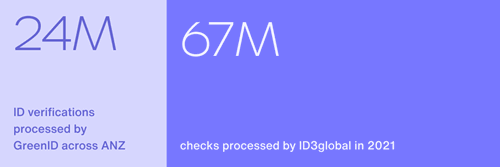

GBG’s identity verification solutions also made milestone advances in 2021.

In the USA, our award-winning identity verification and fraud prevention service, ExpectID, added a sophisticated new API layer to simplify customer integrations: allowing access to our complete portfolio of verification methods with full decision transparency, additional fraud analysis, and of course, leading Know Your Customer (KYC) checks. The ExpectID service is also optimised to help those “hard-to-know” consumers (new-to-country, minors, and sometimes pensioners) who often do not have an established credit history to prove their identity.

In EMEA, we responded to the needs of midmarket businesses for easy-to-use KYC and Anti-Money Laundering (AML) checks with new services such as ProID, recognising that SME customers require a simplified service model. We also added new data feeds across our identity verification portfolio, including Mobile Signal Intelligence, which integrates real-time mobile network operator data to confirm the location of a customer during a transaction.

Meanwhile, in Australia we are adding new biometric capability and potential fraud indicators to our leading identity verification service, greenID; supporting customers in traditional financial services, fintech, telecoms, utilities, gaming and the public sector and resulting in our strongest yearly performance in the region.

As the number of digital transactions grew in 2021, so did GBG, with Acuant, the leading US specialist in AI-powered digital identity verification, joining the roster of GBG companies in November and adding exciting new data orchestration services to the Group. These additional capabilities combine to allow us to build on the growth we’ve seen in all regions this year and continue to offer our customers the most complete identity verification service on the market.

Fraud prevention

The continued growth in digital transactions has of course bought with it an increase in online fraud. Our portfolio of fraud prevention products helps detect fraud at the point an application is made and also monitors transactions for anomalies that might indicate fraud is occurring.

These services are more relevant than ever in 2021, and we were delighted to see a partnership formed with CTOS IDGuard to share GBG capabilities across the leading banks in Malaysia. Alongside great new opportunities for sharing consortium data across South East Asia, we continued to win new GBG customers across the APAC region, in Indonesia and the Philippines, and launched new services for consumer finance customers in Vietnam.

Identity fraud is growing fast. We see increasing numbers of synthetic identities being created, more theft of personal credentials and identity by fraudsters, and we recognise this as a growing problem for our customers. We will respond by building upon the existing fraud analysis tools developed by our IDology team, combined with technology from our Acuant team to deliver new services that can detect fraudulent identities and deploy this service across all our territories.

Looking forward to 2022 with confidence

We are now more than 1,200 location, identity, and fraud experts, operating across the globe and serving more than 21,000 customers – building trust in the digital world. Our sincere thanks and seasonal best wishes go out to all those customers who have placed their trust in us this year.

In 2022, we are ideally positioned to solve our customers’ problems resulting from the increasing demands of digitalisation. We will continue to deliver world-class technology across the digital commerce lifecycle, balancing consumer expectations for speed in accessing products and services, and our customers’ ambitions for growth, with effective solutions that keep our customers compliant with global regulation.