ausbiz TV interview Why greenID facial biometric verification appeals to consumers

In particular to the financial services industry, the exploration and adoption of biometrics was accelerated in 2020 as more financial services organisations caught onto rising consumer demand, however historically, traditional banks and financial institutions have been slow to implement digital transformation plans. The latest World Economic Forum report into AI in automation in the finance sector uncovered that Australian financial enterprises lag significantly behind their international counterparts.

Simultaneously, a growing ecosystem of local and international fintech startups are further strengthening validation that Australian consumers are more than ready for change, putting increasing pressure on the traditional players to more seriously explore what were previously seen as high-risk or unknown technologies.

Biometrics is one of the most common technologies differentiating the industry’s new joiners from the laggards, presenting a seemingly obvious place to start for banks and financial institutions wanting to improve their customer experience and engagement levels in 2021 and beyond.

So, where is the hesitation coming from?

The security of biometrics is still misunderstood

Traditional financial institutions regard biometrics as an emerging technology, which involves the collection of highly personal information and data, such as fingerprints or voiceprints, and therefore introduces a heightened security risk. The impetus to implement safe habour measures and abide by relevant regulations has also introduced hesitance among some financial institutions that are not yet familiar with how to achieve safe harbor with digital biometric verification.

Meanwhile, new financial players are recognising the reality that the onus is on the financial institutions to adopt and implement appropriate identity theft, fraud, and security technology and measures that mitigate this risk. With the right preventative technology in place, digital products can be creatively designed and deployed to deliver the innovation consumers are expecting from service providers. Digital verification of identity can also help financial institutions make more effective and accurate judgement calls, in comparison to having to solely rely on personal identification methods.

Furthermore, looking at recent data and how the pandemic has impacted the cybersecurity landscape, it is clear that long-standing risks related to consumer behaviour such as simple or re-use of passwords, over-sharing of personal information on social media, and succumbing to romance scams on online dating apps are still highly common scenarios. Unlike a security token device which many banks still use for consumers to access their online banking records, or a pin number or password which is likely similar to ones used for other services and therefore highly susceptible to cybercrime, one’s own biometrics cannot be easily physically passed, shared or stolen between people.

The complexity of biometric data and uniqueness of individuals’ own biometrics present new standards in personal data security and customer experience. Some government and private organisations are already demonstrating how biometrics can streamline service delivery, such as Services Australia, which has had more than 1.2 million people sign up to register their voiceprint, enabling identity verification over the phone.

Striking a balance amid the need for speed

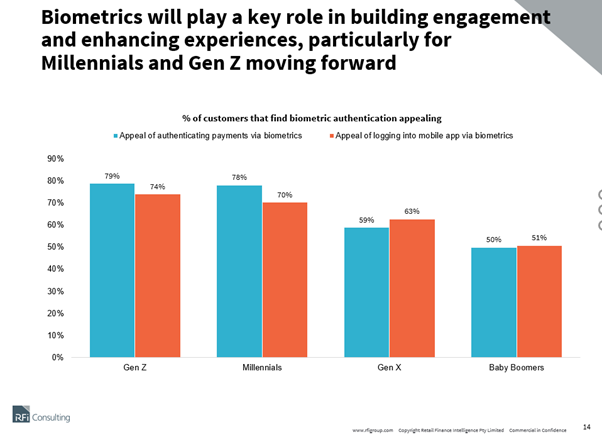

Particularly during the pandemic, consumers have expected financial institutions to quickly deliver services to meet their new and constantly evolving digital finance needs. Millennials and Gen Z are especially fast adopters of digital and mobile banking solutions, and are increasingly open to trying new types of services if the price is right and the experience is seamless.

This curiosity among digital natives mixed with a financial downturn pushing all consumers to re-consider their most cost-effective options has created a race among traditional and new financial institutions to deploy digital services quickly, as well as deploy services that deliver streamlined and automated onboarding solutions.

Up Bank, for example, enables consumers to sign up digitally in an average of two minutes and 11 seconds, while 86 400 offers home loan approvals that take hours rather than days. Meanwhile, fintech lender Wisr recently publicised record growth, reporting a 47% quarter on quarter increase and 166% increase in the previous corresponding period. These fast-growing innovators have not only shown a speed to market and aptitude to scale in recent years, but also reflected the high demand among consumers for fast and simple financial and banking services built on end-to-end automated processes.

Biometrics have played a key role in enabling fast service delivery and adoption, including users taking selfies with their driver’s licenses to prove their identity. Moving forward, biometrics also presents interesting opportunities to develop solutions for people with complex or no identity documentation. This is particularly common in the unbanked and underbanked segments of South-East Asia, local migrant and refugee communities, and remote and Indigenous communities in Australia. Instead of having to exclusively rely on traditional identity documentation such as birth certificates and proof of age, using one’s own biometrics could introduce new ways to help understand and verify a customer’s identity.

As financial organisations and startups prepare for 2021, amid high likelihood of ongoing social distancing and a shift away from physical in-branch banking, the opportunities for biometrics to streamline the identity verification process and mitigate fraud need to be properly explored. Growing competition across the sector will lead to the emergence of even more industry disruptors in the coming years, and those fastest to securely leverage the latest technologies will capture customer loyalty early and sustain it long-term.

View a demo on greenID, our digital identity verification platform solution.

- Insight

- Video

- Identity