GBG Announces New Report on Future-proofing Fraud Prevention for Indonesian Financial Institutions

Jakarta, 30 September 2020 - GBG (AIM: GBG), a leading global technology specialist in fraud and compliance management, identity verification and location data intelligence, finds in their “Future-proofing Fraud Prevention in Digital Channels: an Indonesian FI Study” research that the rate of fraud in Indonesia show no signs of ebbing and projects an escalation of money mule fraud typology in 2020-21, impacting banking and finance consumers.

Source: Future-proofing Fraud Prevention in Digital Channels, GBG and The Asian Banker, June 2020

GBG collaborated with The Asian Banker to conduct a survey across 324 respondents from financial institutions (FI) in six Asia Pacific (APAC) countries, Australia, China, Malaysia, Thailand, Vietnam including Indonesia, to analyse the impact of fraud on FIs and the technologies they are planning to invest in to mitigate today's fraud threats and scale to address emerging fraud patterns.

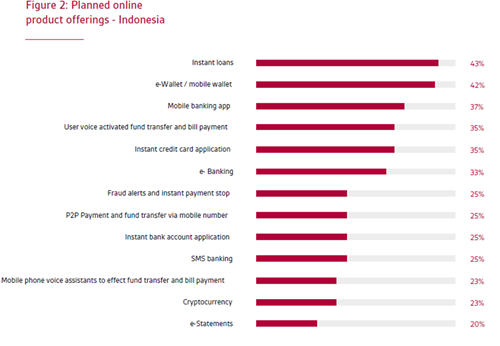

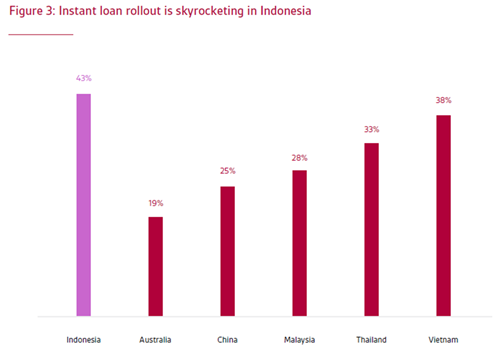

Financial institutions in Indonesia are in a battle with escalating complexity and volume of fraud and cyber-attacks as fraudsters take advantage of pervasive digital usage. Indonesia sees an increase in online connectivity during the Covid-19 pandemic and the Large-Scale Social Restrictions (PSBB) across the archipelago as FIs’ customers are resorting to mobile and app banking to access financial products and services. Rolling out instant loan products would be a top priority for 43% of FIs in Indonesia for 2020-21 to ensure their consumers have ready access to loans should the PSBB continue and to adjust to the new norm. The focus to accelerate the availability of instant loan products in Indonesia is seen to outstrip the rest of the countries in APAC this year.

Source: Future-proofing Fraud Prevention in Digital Channels, GBG and The Asian Banker, June 2020

Source: Future-proofing Fraud Prevention in Digital Channels, GBG and The Asian Banker, June 2020

Challenges and Solutions to Fraud or Cyber Financial Crimes for Indonesian FIs

Have you ever gotten a text message asking you to open a bank account to help manage transactions for another person in return for a commission? If yes, that means you have come across a very common combination of scam and first-party fraud that is a huge challenge to detect called money mule.

Often involving coordinated social engineering and an unsuspecting first-party scenario, the fraudster acquires money from the victims by having the victim's front account applications and transactions. Money mule was rated as the second most impactful scam on financial institutions in Indonesia in 2019. Indonesian FIs have to be warier of money mule as it is forecasted that this type of fraud will rise up to 68% in 2020-21.

In the same survey report, GBG notes that synthetic (55%) and stolen ID (53%) join money mules as the fraud types with the highest growth rate in Indonesia this year. In light of this, financial institutions in Indonesia are advised to keep an eye on the safety and security of their customers while using their digital products.

June Lee, APAC Managing Director of GBG said, “It is an ongoing challenge for Indonesian FIs to help consumers gain familiarity and trust in digital financial products. Indonesians, by and large, are very accustomed to face-to-face engagement; through the research, the Unbanked, a segment who has not subscribed to any banking services historically, also projects the largest growth rate as a new customer segment focus by local FIs. It is not just about getting consumers to cross the chasm to digital adoption, but for organisations to have the means to innovatively converge mobile credit risk scoring with fraud technology to bridge the lack of data. Striking a balance to negate the rise of digital fraud patterns and to create a safe digital banking environment for Indonesians.”

Source: Future-proofing Fraud Prevention in Digital Channels, GBG and The Asian Banker, June 2020

As of now, financial institutions in Indonesia estimate a budget of USD$88.9 million to purchase new fraud prevention technology in 2020. This makes Indonesia the country with the third-highest budget to prevent fraud in the APAC, following Thailand and China.

Today, GBG offers its proprietary Digital Risk Management and Intelligence Platform encompassing the entire digital onboarding and transaction monitoring customer journey. The platform offers the option to add on the GBG Machine Learning module to lower false positive and another orchestration module to enhance fraud detection by managing third-party call-outs to a comprehensive range of solutions and data to help financial institutions and governments fight fraud and cyber financial crime. This end-to-end digital fraud and compliance technology enable banking and non-banking FIs to increase online fraud detection accuracy by 30% hence, improving the customer experience while helping to protect the more vulnerable people in our society.

For more insights into the research, download our report: “Future-proofing Fraud Prevention for Digital Channels: APAC FI Study”

To access the series of Future-proofing Fraud Prevention in Digital Channels reports, visit:

- Indonesia Financial Institution Study

- Malaysia Financial Institution Study

- Australia Financial Institution Study

- APAC Financial Institution Study

To find out more about how we help our clients establish trust with their customers, visit www.gbgplc.com/apac, follow us on Twitter @gbgplc or LinkedIn.

- Technology

- Insight