Financial Crimes 4.0 Trends

What constitutes Financial Crimes 4.0, its complexities and its impact

Use Cases

The fraud and compliance measures undertaken today by financial institutions

Mitigating Solutions

The play in data orchestration, machine learning, cyber intelligence and emerging technologies for optimum risk protection

2020 outlook and practical insights to combat modern day fraud

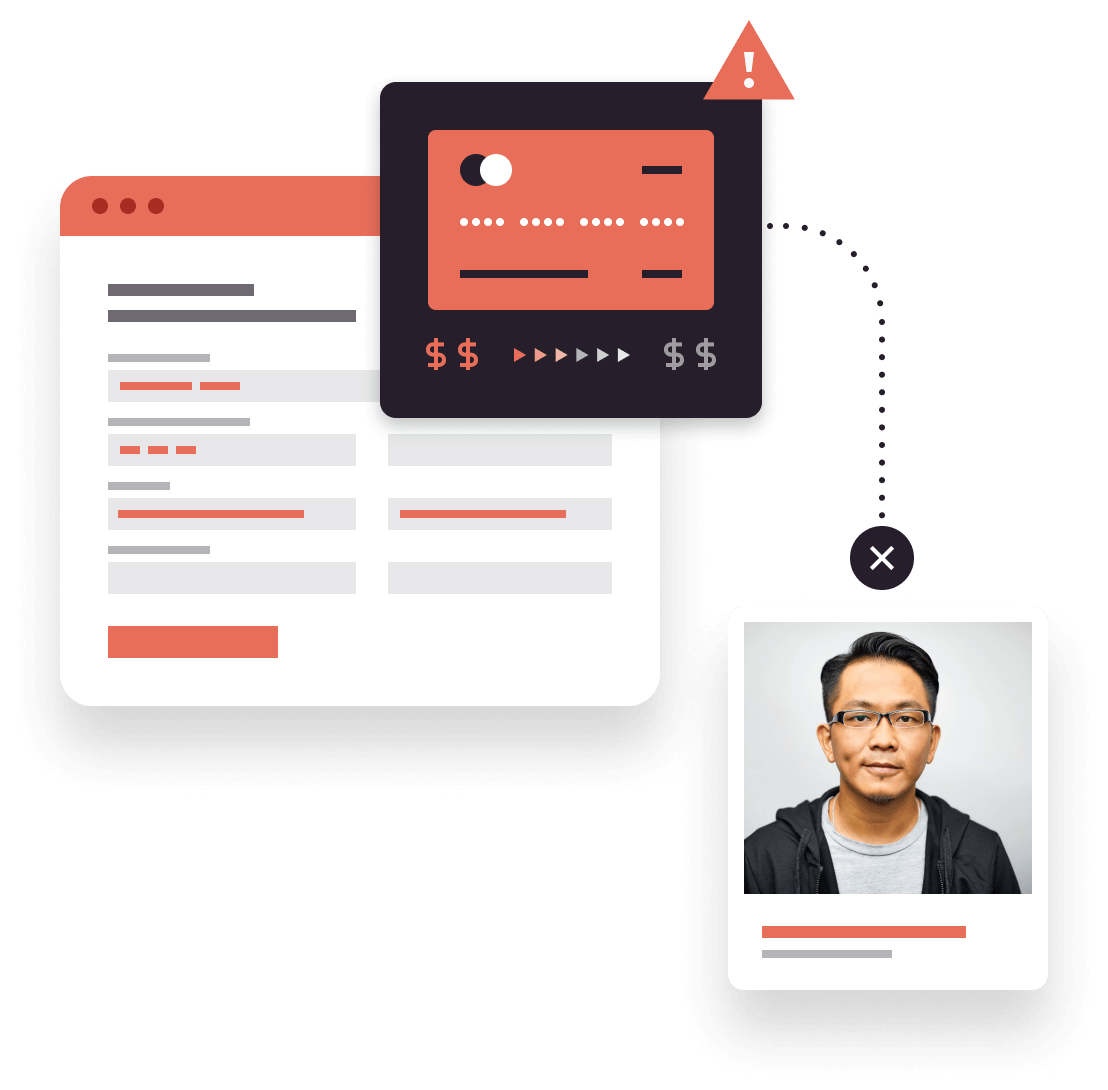

The age of Industry 4.0 has led us into the age of Financial Crimes 4.0. In a hyper-interconnected world of social media, digitization and internet of things, complexities and scale of fraud and compliance incursions are peaking in sophistication and has opened up new access points.

How should financial institutions brace themselves for the spectrum of financial frauds from social engineering, identity thefts, account takeovers, cybercrimes, to illicit money laundering?

Watch now

A 2020 outlook into financial crimes and use cases with practical insights to combat modern-day fraud.