Assess customer risk with fraud checks tailored to your needs. Proprietary insights and scores offer confidence in the legitimacy and trustworthiness of your customers' identities.

Onboarding criminals using stolen or synthetic identities, or impersonating deceased individuals, incurs losses and damages brand reputation. Our modular solutions can prevent fraud at the application stage.

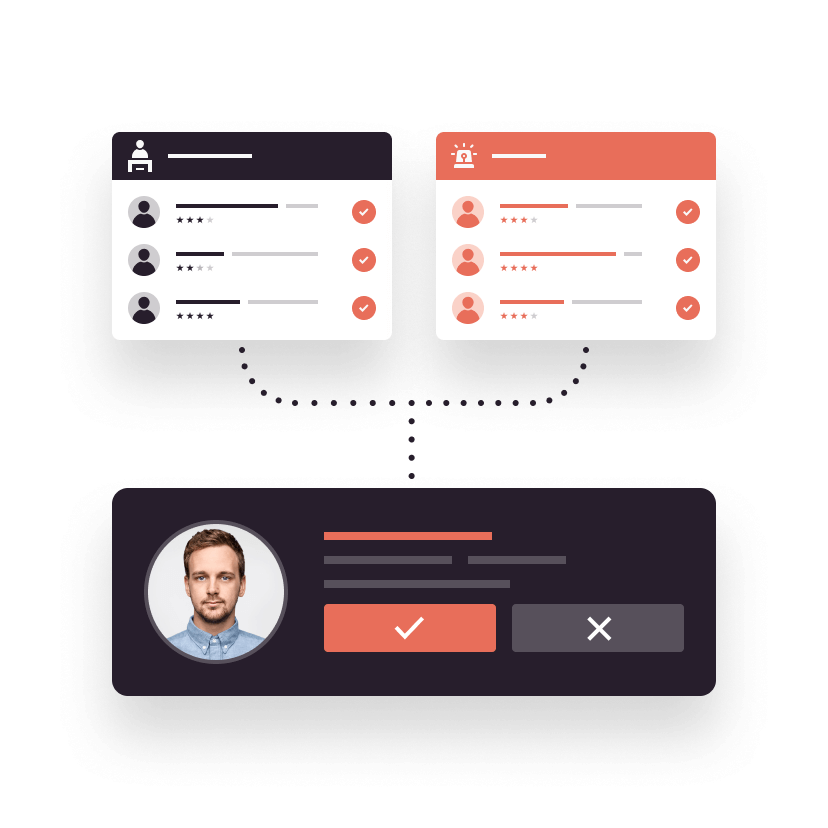

Avoid financial fraud, utilising our multi-layered approach. Our proprietary scoring of transactional behaviour, layered with bank verification helps to identify suspicious patterns and confirm the authenticity of an individual's identity.

The true extent of lost earnings from the misuse of new customer promotions is underestimated in online gaming, retail, and software. Our fraud prevention solutions accurately verify identities and prevent losses.

With exclusive access to the entire credit universe we analyse and contextualise credit bureau data for synthetic identity indicators using an advanced scoring model to prevent fraud before it occurs.

GBG Trust Network is a collaborative intelligent database, sharing verified identity histories and fraud insights with global organisations. With Trust score you can have confidence that the identity you're transacting with is trustworthy.

A mobile number often stays with a person longer than their address. Knowing that a person is the owner of a mobile number is a robust way of validating an identity and preventing fraud.

Assess the potential risks and avoid fraudulent activities by analysing the transactional and behavioural background of an email address. The resulting fraud risk score makes it easy to assess the risk level of potential new customers.

Prevent fraud losses with card and bank account verification, detecting potentially fraudulent activity before it occurs. Rapidly authenticate sort codes, account numbers, and address details during application, stopping fraud without impacting the customer journey.

| Feature | Fraud Essentials (UK) |

Fraud Lite (UK) |

Fraud Pro (UK) |

Fraud Pro + BAV (UK) |

|---|---|---|---|---|

| GBG Email Intelligence | TRUE | TRUE | TRUE | TRUE |

Basic data checks:

|

FALSE | TRUE | TRUE | TRUE |

| GBG Score for Synthetic Identity | FALSE | TRUE | TRUE | TRUE |

Mobile Intelligence:

|

FALSE | FALSE | TRUE | TRUE |

Advanced data checks:

|

FALSE | FALSE | FALSE | TRUE |

| GBG Score for Trust (from April 2023) | TRUE | TRUE | TRUE | TRUE |

| CIFAS | FALSE | Optional | Optional | Optional |

| Device Intelligence | Optional | Optional | Optional | Optional |

We strive to simplify fraud detection and compliance management for your business. Regardless of your industry or location our solutions are designed to help you address your fraud and compliance challenges, so you can concentrate on running your business with peace of mind.

The ability to make changes quickly, react and minimise fraud losses